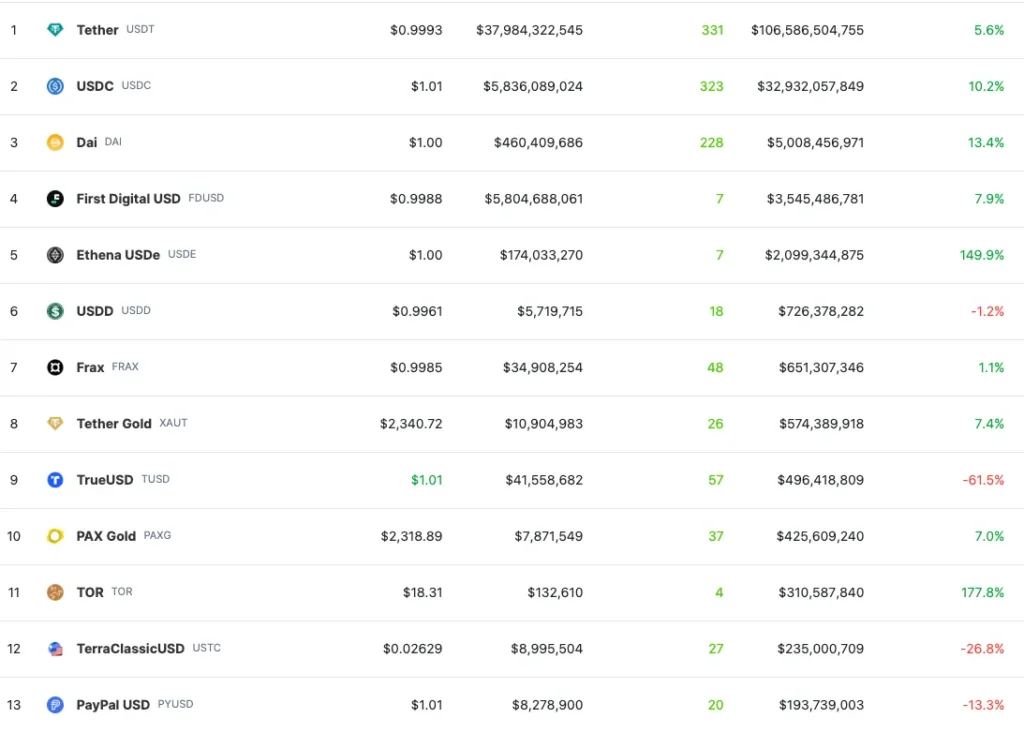

The remarkable landscape of digital currencies undergoes constant changes, as demonstrated by recent developments. Chief among these is the news regarding PayPal’s stablecoin, PYUSD. The circulation of this seemingly steadfast performer in the crypto market has seen a disappointing drop of 38% in the month of March, an event that has caused ripples in the industry. This remarkable reduction has sparked in-depth discussions, with industry insiders and crypto enthusiasts trying to decode this intriguing development.

The decline in PYUSD’s circulation was first brought to prominence by Paxos, the esteemed company overseeing PayPal’s crypto offerings. “PYUSD’s circulation saw a downward trend, dropping by an unprecedented 38% in March,” reported Paxos. This unforeseen dip is considered remarkable considering the otherwise successful performance of PYUSD in the crypto market.

However, part of understanding this shift involves considering the intense, evolving landscape of digital currencies. The crypto arena is inherently volatile, with fluctuating market dynamics and an ever-changing panorama of coins to compete with. Coins can surge to astronomical heights only to plummet soon after – this is all part and parcel of a realm that operates on the exciting, and often risky, frontier of finance.

Moreover, the crypto market constantly demands innovation and resilience from its players. Fundamentally, PYUSD’s drop may indeed reflect this ceaseless challenge. PayPal’s stablecoin will need to heed this wake-up call, using it as a springboard to revise its strategies and bounce back stronger.

Keeping this in perspective, the decline of PYUSD can also be viewed as an opportunity: a chance to adapt, innovate and renew the coin’s standing in the market. A 38% drop is indeed alarming, but it’s far from spellbinding doom for PYUSD. It’s a setback that demands attention and strategic thinking. But if PYUSD can weather this storm, it might just bounce back stronger. The crypto market, after all, thrives on resilience – and a gritty comeback could well be the next headline!