As the landscape of digital finance shifts, cryptocurrency giants like Binance continually adapt to meet both market demands and regulatory expectations. The company has taken a significant step by converting the entirety of its Secure Asset Fund for Users (SAFU) into USD Coin (USDC), emphasizing stability and security. This pivotal change not only indicates Binance’s commitment to ensuring user security but also subtly reflects the evolving dynamics in the cryptocurrency ecosystem where stablecoins are garnering more trust and utility.

Originating in July 2018, the SAFU initiative was initially set up by Binance to act as an emergency insurance fund, crafted in response to the increasing number of hacks troubling the cryptocurrency scene. By allocating 10% of all trading fees into this fund, Binance fortified its defenses, ensuring that it could reimburse users in the event of a breach. This strategic move not only boosted user confidence but also showcased a proactive approach in safeguarding assets.

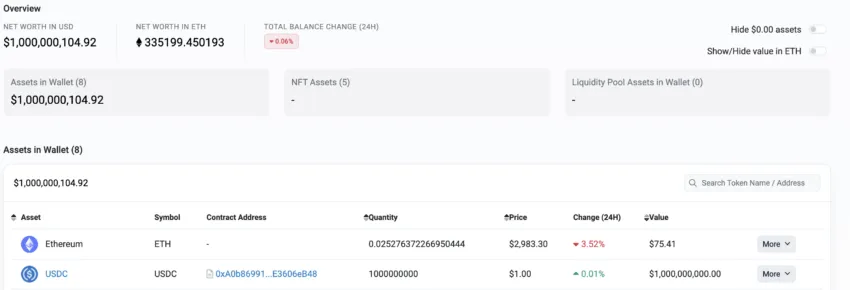

As of September 2023, in a move reflecting both prudence and strategic foresight, Binance has entirely converted these funds, which previously included various cryptocurrencies, into USDC. This decision aligns with a broader trend toward the higher assumed stability of fiat-collateralized stablecoins, compared to cryptographic assets that can be volatile. USDC, in particular, is recognized for its strong peg to the US dollar and is governed by financial audits that ensure every token is adequately backed by fiat, making it an ideal choice for securing Binance’s SAFU.

This alignment with USDC is indicative of Binance’s nuanced understanding of cryptocurrency’s volatile nature and its implications for security frameworks. By opting for a stablecoin that adheres closely to the US dollar, Binance ensures that the value of the SAFU remains unaffected by the swings typical of cryptocurrencies. This is particularly crucial in maintaining the fund’s value neutral, ensuring that it’s sufficiently capitalized to cover any potential security lapses.

Furthermore, Binance’s adjustment can be seen as part of a larger, industry-wide shift where major platforms are reconsidering their strategies in response to both market conditions and tougher regulatory scrutiny. Stablecoins like USDC, by virtue of their stability and reliability, are increasingly becoming the backbone of transactional services in crypto, creating a safer, more predictable environment not just for trading but for long-term strategizing in asset protection.

In essence, Binance’s decision to convert its SAFU wholly into USDC does not simply reflect a tactical financial shift within one company but illustrates a maturing of the sector, moving toward greater assurances of security and stability in a landscape known for its turbulence. This move could potentially set a standard, influencing how other platforms manage their risk and security measures. Binance remains at the forefront, evolving with the changing tides of cryptocurrency’s vast oceans, yet firmly anchoring its commitment to user security and market integrity.