The Impact of Bitcoin ETF Outflows on the Cryptocurrency Market

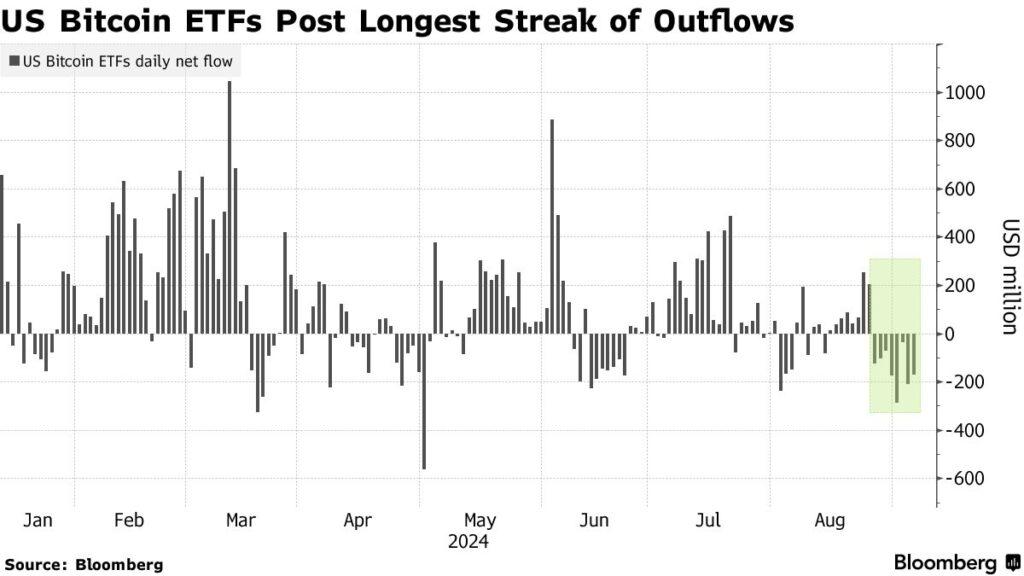

In a span of just eight days, Bitcoin ETFs have seen a staggering $1.2 billion outflow, raising eyebrows across the cryptocurrency landscape. The phenomenon, although dramatic in numerical terms, sheds light on the nuanced relationship between financial instruments and digital assets.

Bitcoin ETFs were initially hailed as a bridge between traditional financial markets and the burgeoning world of cryptocurrencies. They offered investors an accessible way to gain exposure to Bitcoin without the complexities of purchasing and storing the cryptocurrency directly. However, this recent significant outflow suggests that investor sentiment towards these financial products is shifting, influenced by a range of factors from market fluctuations to regulatory changes.

One pivotal element contributing to the outflows is the market’s inherent volatility. Bitcoin, known for its erratic price movements, often responds to a complex web of influences including macroeconomic conditions, regulatory announcements, and broader market trends. When the market enters a bearish phase or faces uncertainty, investors typically reconsider their exposure to riskier assets, prompting withdrawals from ETFs that are closely tied to Bitcoin’s performance.

Moreover, regulatory landscape changes play a critical role in shaping investor behavior. With different jurisdictions often sending mixed signals about the acceptance and regulation of Bitcoin and other cryptocurrencies, investors remain cautious. Any hint of stringent regulatory measures can trigger a pullback, as witnessed in recent times. For instance, speculations about increased regulatory scrutiny in major markets like the United States or China can cause significant market jitters, leading to outflows from related financial products like Bitcoin ETFs.

Adding another layer to this complex scenario is the evolving competitive environment within the cryptocurrency market itself. With the advent of alternative investment vehicles and the proliferation of new digital assets, some investors are diversifying their portfolios. The emergence of new-age DeFi (Decentralized Finance) platforms offering potentially higher returns has also lured traditional ETF investors away, contributing to the notable capital flight from Bitcoin ETFs.

The implications of such large outflows extend beyond immediate market reactions. They potentially signal a broader shift in investor strategies and market sentiment. Institutional investors, who often wield significant influence, may begin to reevaluate their positions, potentially impacting future flows and market stability. This introspection among large players often trickles down to retail investors, creating a cascading effect and further amplifying market trends.

To understand the broader context, one must consider the intricate dance of supply and demand forces at play. The outflows from Bitcoin ETFs not only reflect current investor sentiment but also influence the market’s liquidity. When substantial sums are withdrawn, it can create short-term liquidity crunches, exacerbating price volatility. Conversely, during periods of net inflows, a stabilization effect is often observed as increased liquidity supports more stable price movements.

In conclusion, the $1.2 billion outflow from Bitcoin ETFs over eight days is a testament to the dynamic and ever-evolving nature of the cryptocurrency market. While it underscores the challenges and uncertainties that pervade this space, it also highlights the continuous adaptation and strategic shifts among investors. As the market matures, such events will likely offer valuable insights, guiding stakeholders through the intricate interplay of traditional financial mechanisms and innovative digital assets.