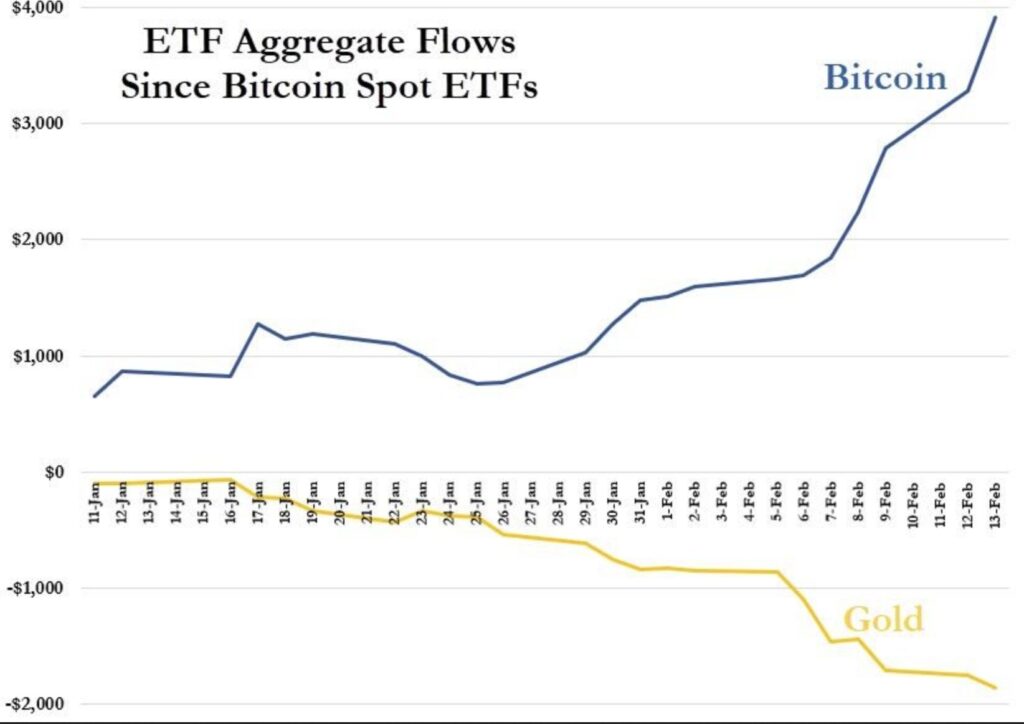

In 2024, exchange-traded funds (ETFs) that track gold have seen a significant loss of funds, with a total of $2.4 billion in outflows, while Bitcoin ETFs have experienced a surge in investment. Eric Balchunas, an analyst from Bloomberg, shared on February 14 that out of the 14 major gold ETFs, only three had any inflows, with the rest experiencing losses. The most significant losses were from two of BlackRock’s iShares Gold Trusts.

Conversely, the 10 Bitcoin ETFs that were approved have collectively received $3.89 billion in investments since their start on January 11, hitting record trading volumes, according to data from Farside.

Bitcoin Munger, a portfolio manager, noted that while Bitcoin ETFs are attracting funds, gold ETFs are losing assets at a notable pace. Balchunas suggested that the shift from gold to Bitcoin ETFs might not be a direct migration but could be influenced by a general fear of missing out (FOMO) on U.S. equity markets.

Jameson Lopp, a Bitcoin enthusiast, highlighted the difference in performance between gold and Bitcoin ETFs, playfully questioning gold investor and Bitcoin critic Peter Schiff’s stance in light of these developments.

ETF aggregate flows since spot BTC ETF launch. Source X/Jameson Lopp

The price of gold has decreased by 3.4% since the start of 2024, hitting a two-month low on February 14. Meanwhile, Bitcoin’s value has risen by 23.5% in the same timeframe, reaching a two-year high on the same day.

The World Gold Council attributed gold’s poor performance to global gold ETF outflows and decreased speculative betting. Other factors, like robust U.S. economic data boosting long-term Treasury bonds and the U.S. dollar, have also been challenges for gold.

Despite Bloomberg’s senior commodity strategist Mike McGlone’s prediction in January that gold would outperform Bitcoin in 2024, the current trend appears to contradict his forecast. Bitcoin and gold are often compared as investment choices during economic and geopolitical uncertainties due to their perceived value preservation qualities.