Ether, the cryptocurrency behind Ethereum, hasn’t risen above $2,350 for the past 15 days. However, some traders are hopeful that the rally on February 6 might lead to a significant trend change.

These traders are keen to see if the recent network issues with Solana and the large amount of Ether moving out of exchanges last week will affect Ether’s price. They are also wondering if Ether can increase by another 10% to reach the $2,650 level, last seen on January 12.

Ethereum Continues Leading in DApp Usage

On February 6, Solana’s network was down for five hours, which stopped the production of new blocks and led multiple exchanges to pause deposits and withdrawals of SOL and tokens based on Solana. This situation highlighted the ongoing challenges that Ethereum’s competitors face in staying operational during high-demand times, emphasizing Ethereum’s strong position in the decentralized application (DApp) space.

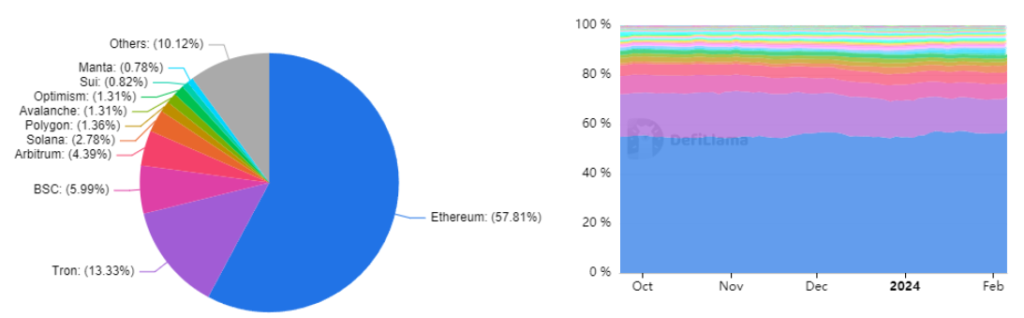

A user named @tytaninc on the X social network pointed out that despite criticisms about Ethereum’s congestion and high fees, it still has a significant 57.8% market share in DApp deposits or total value locked (TVL), amounting to $34.8 billion. This share increases to 67.4% when considering layer-2 solutions like Polygon, Optimism, and Arbitrum, as reported by DefiLlama.

Blockchain ranking by TVL market share. Source: DefiLlama

Despite Ethereum’s average transaction fee of $5.85, which might seem high, it had 382,490 active addresses interacting with its DApps last week. The leading DApps were Uniswap, 0x Protocol, Metamask Swap, OpenSea, and 1inch Network. When adding layer-2 options, the number of active addresses jumps to over 2 million, according to DappRadar.

Ether’s Exchange and Staking Trends Show Positive Signs

Beyond DApp statistics, the movement of assets is a crucial price determinant. For example, the recent Solana network downtime didn’t affect its token’s price or network deposits. This shows the importance of watching the exchange and staking data. Generally, fewer coins available immediately can lead to a price increase when demand goes up.

Recent data shows Ether reserves on exchanges have dropped to their lowest in more than a year, with 7 million ETH withdrawn since April. This indicates that holders are reluctant to sell their coins. To understand the sentiment around selling Ether, looking at Ethereum’s staking data is helpful.

Staking is when people lock up their coins to help validate transactions, a crucial part of Ethereum’s network operation. Increased staked coins are usually a good sign for Ether’s price. A record 29.6 million ETH is staked, an increase from 28.9 million a month ago, as per StakingRewards.

Ether Derivatives Indicate a Balance Between Optimism and Caution

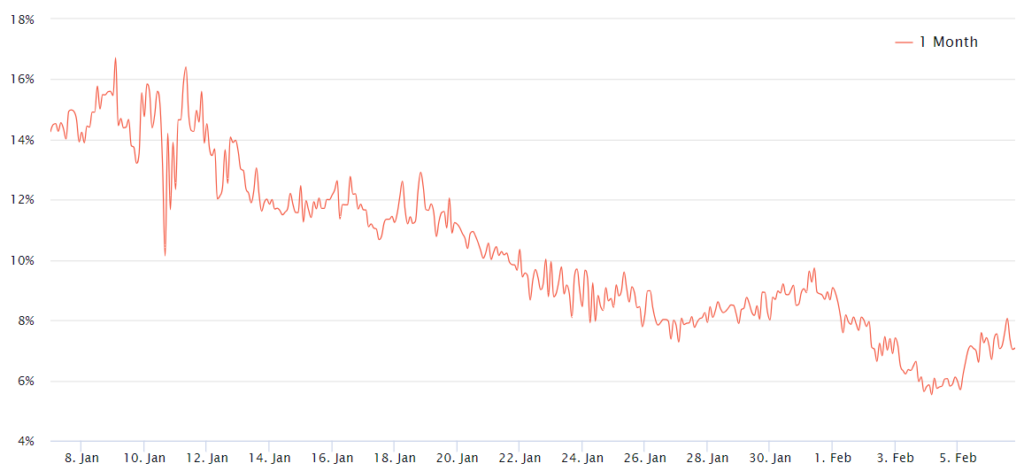

To gauge whether Ether investors are becoming more optimistic, looking at the ETH futures premium is helpful. This premium should be between 5% and 10% in neutral markets, accounting for the time until the contract settles.

Ether futures 1-month premium. Source: Laevitas

On February 6, the ETH futures premium was 7%, below the neutral market range, but slightly improved from two days before. This suggests a balanced interest in buying and selling positions over the past week.

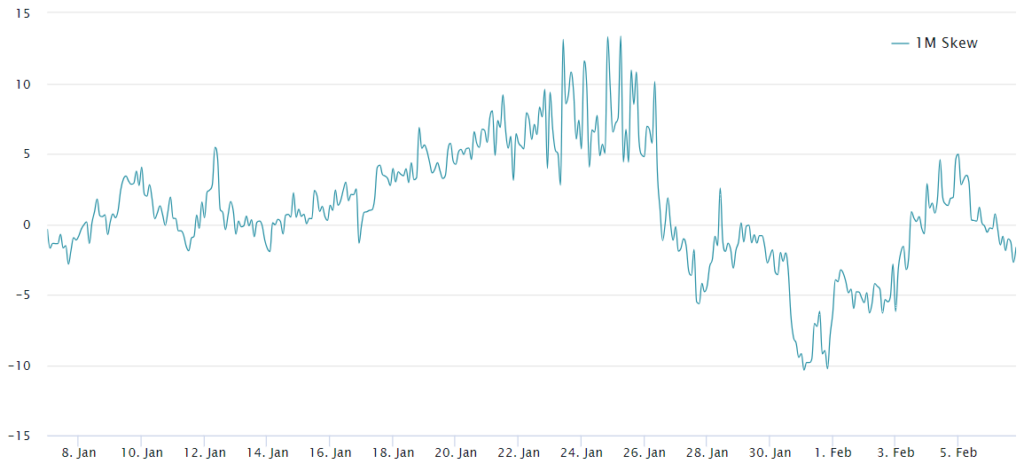

Additionally, the ETH options market, specifically the 25% delta skew, shows the balance of sentiment. This measure has been neutral since February 2, indicating neither widespread fear nor optimism.

Ether 30-day options 25% delta skew. Source: Laevitas

Despite the small gain of 3.9% on February 6, there’s no clear evidence of optimism in Ether’s futures and options markets, indicating a moderate level of distrust in the current price. If Ether’s price rises, it could surprise many professional traders.