Despite reaching near two-year price peaks, Bitcoin’s online interest has plummeted to levels reminiscent of a bear market, with a significant 80% drop in engagement since the week the ETF was approved. This decline in retail interest and online searches contrasts sharply with the soaring market values, currently only a quarter of the frenzy observed during the 2021 market surge.

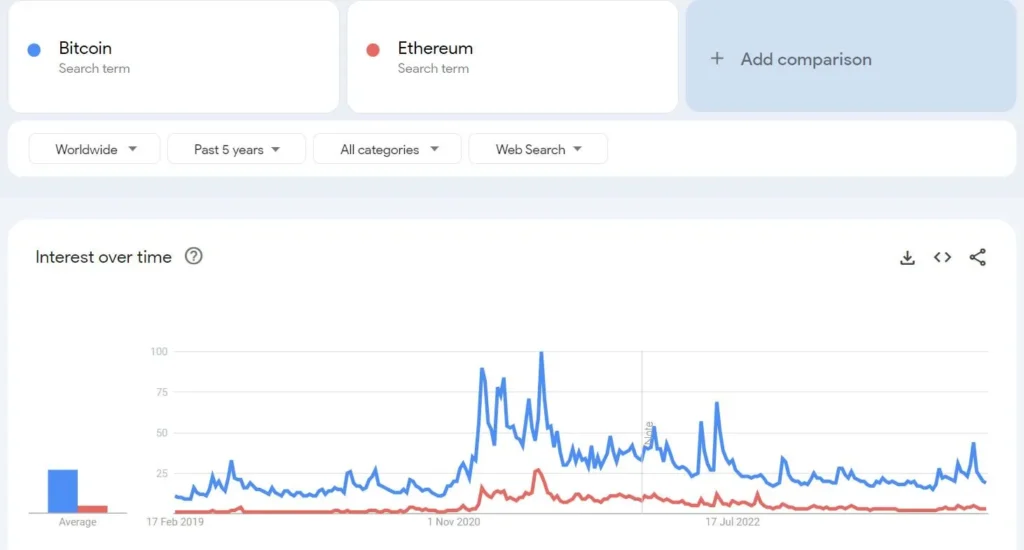

Social media discussions and Google Trends data reveal a stark decline in crypto engagement, mirroring bear market sentiments. This drop is evident despite the cryptocurrency market and Bitcoin prices nearing their highest in two years, indicating a disconnect between market performance and public interest.

Google Trends analysis shows that the number of searches for ‘Bitcoin’ has fallen to its lowest in the current cycle, especially after a temporary increase in January coinciding with the launch of spot ETFs in the US. Commentary from Bitcoin Archive highlights the early phase of the current cycle and notes an 85% decrease in Bitcoin search trends since the last peak, a trend mirrored by Ethereum searches despite record levels of ETH staking.

The atmosphere is described as reminiscent of a bear market, with consistent but limited engagement from the usual community members. Despite Bitcoin’s price nearing its all-time high, search interest is significantly lower than during the 2021 bull run.

The Bitcoin subreddit’s growth has been steady yet lacks any significant increase in activity or interest, aligning with the overall trend of reduced engagement across platforms. However, contrasting this apathy, the Bitcoin fear and greed index indicates a sentiment of ‘greed’ with a score of 70, highlighting a discrepancy between market sentiment and online engagement.

Experts suggest that retail FOMO (Fear of Missing Out) typically emerges near the market’s peak, possibly still some time away. They speculate that surpassing the $70,000 mark could ignite a new wave of retail interest.

Fred Krueger, an investor and analyst, observed that American interest in investment spikes primarily during rapid market upswings, a pattern consistent across various investment searches. Despite the current trading price of Bitcoin around $48,000, following a 12% increase over the last week, the general public’s engagement remains tepid, hinting at a focused but quiet attention from the market.