Bitcoin Whale Accumulation Signals Bullish Momentum for 2024

As the landscape of Bitcoin investment evolves, attention shifts toward the recent patterns of whale accumulation which could hint at a significant bull market in 2024. Bitcoin, the premier cryptocurrency, has seen various phases of intense buying by large investors, affectionately termed “whales.” These Bitcoin whales, entities holding large quantities of BTC, play a pivotal role in market dynamics due to their substantial impact on liquidity and price movements.

Accumulation Trends and Insights

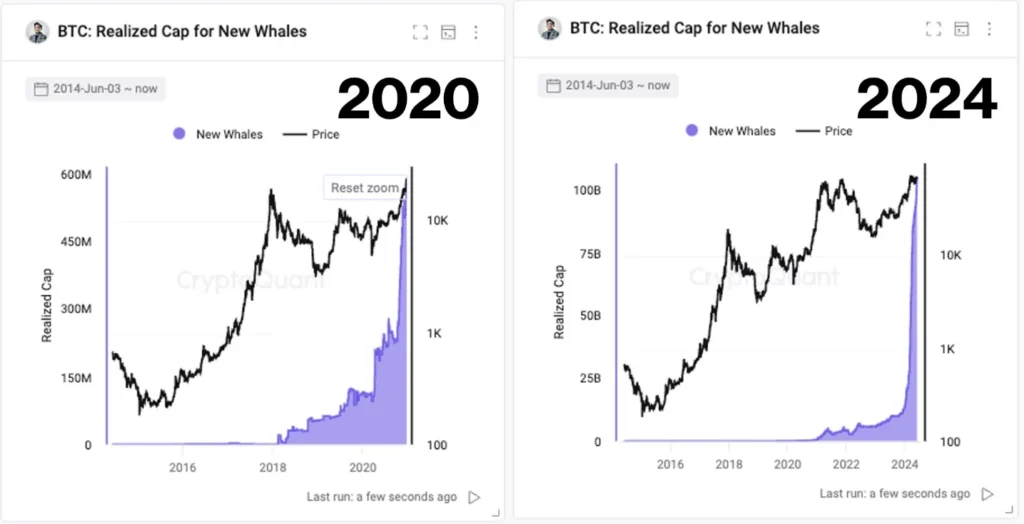

Throughout 2023, data has highlighted a robust accumulation trend among Bitcoin whales. According to CryptoQuant CEO Ki Young Ju, these influential investors have consistently increased their holdings, hinting at a strong belief in Bitcoin’s potential for future appreciation. The data from CryptoQuant reveals that whale wallets, those containing between 1,000 and 10,000 BTC, have notably surged.

Historical Context and Patterns

Understanding the broader implications requires a look into historical accumulation patterns. Typically, whale accumulation often precedes significant price rallies. For instance, before the monumental bull run of 2017, there was a marked increase in whale activity. Such historical precedents create a compelling narrative that the current accumulation phase might be a precursor to a substantial market movement in 2024.

Market Sentiment and Economic Indicators

The behavior of Bitcoin whales can often serve as a barometer for market sentiment. Presently, various economic indicators further support a bullish outlook. Factors such as increased institutional interest, evolving regulatory frameworks, and growing mainstream adoption contribute to a positive ecosystem for Bitcoin.

Institutional investments have particularly seen a notable uptick. Companies like MicroStrategy and Tesla have made significant inroads by adding Bitcoin to their balance sheets. This wave of institutional acceptance has provided additional credibility to Bitcoin, encouraging further accumulation by both retail and large-scale investors.

Regulatory Landscape and Its Influence

The regulatory environment plays an undeniably crucial role in shaping market confidence. Recent advancements in creating more defined cryptocurrency regulations have alleviated some of the uncertainties that previously plagued the market. Clearer regulations tend to foster an environment conducive to investment, as they reduce at least some of the risks associated with legal ambiguities.

Technological Developments and Prospects

Parallel to regulatory and institutional developments, the technological advancements within the Bitcoin network are noteworthy. The ongoing enhancements and scalability solutions aim to bolster the network’s efficiency and security, addressing some of the critical challenges faced by the cryptocurrency. Such improvements are likely to attract more users and investors, fostering a robust market ecosystem.

Psychological Factors and Behavioral Economics

Beyond tangible metrics, psychological factors also play a significant role. The herd mentality in financial markets often leads to self-fulfilling prophecies. As whales accumulate Bitcoin, the perception of an impending bull run gains traction among retail investors, who, in turn, contribute to the upward momentum by increasing their own investments.

Understanding whale accumulation isn’t just about analyzing wallet balances; it’s about interpreting broader narratives and market signals. The current accumulation trend reflects a confluence of favorable factors, ranging from institutional acceptance and regulatory clarity to technological advancements and positive market sentiment.

Conclusion

The substantial whale accumulation observed in 2023 sets a promising stage for 2024. If history is any indication, this trend could mark the beginning of a new bull phase for Bitcoin, driven by multifaceted factors including institutional investment, regulatory improvements, and technological innovations. As the narrative unfolds, both seasoned investors and newcomers should keep a keen eye on whale activities, as they can offer valuable insights into the cryptocurrency’s future trajectory.

In sum, while the exact future remains uncertain, the present indicators suggest a bullish horizon for Bitcoin, propelled by the strategic accumulation practices of whales and underpinned by an evolving market landscape.