On February 6, the U.S. Securities and Exchange Commission (SEC) introduced new regulations requiring additional market players to register with the SEC, join a self-regulatory body, and follow federal securities laws and rules. These changes are set to bring cryptocurrency and decentralized finance (DeFi) under closer scrutiny.

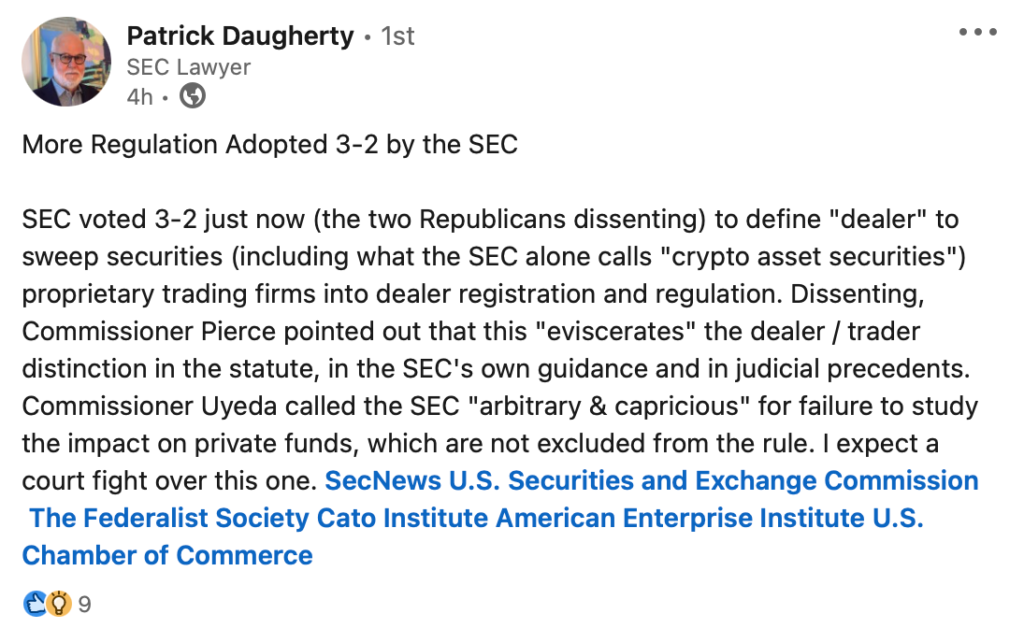

The regulations, detailed in a document spanning 247 pages, were initially proposed in 2022. They offer a new definition of “dealer” and “government securities dealer” as per the Securities Act Rules, and they also redefine what it means to be engaged “as a part of a regular business,” according to the Securities Exchange Act of 1934.

These rules target market participants “who take on significant roles in providing market liquidity.” Under the new definitions, a dealer could be someone who “shows trading interest that is very close to the best prices available for buying and selling the same security” or makes money “mainly by taking advantage of the difference between the buying and selling prices, or through rewards provided by trading platforms for offering liquidity.” SEC Chair Gary Gensler explained:

“These steps are just common sense. […] Unless exempted or excepted, if someone trades in a way that fits with acting like a market maker, they need to register with us as a dealer – which is what Congress wanted.” The new rules have a threshold: Dealers who manage or control assets of $50 million are subject to these rules.

The decision to adopt these rules was made along party lines, with the two Republican members of the SEC voting against it. The proposed rule from 2022, which was 194 pages long, barely mentioned crypto and only referenced it in a footnote. However, the crypto industry and some politicians who support crypto raised concerns about it. The final version of the rules dedicates a whole section to crypto, stating:

“The framework for determining who is a dealer is based on the securities trading activities a person undertakes, not the type of security traded.”

Four out of the five SEC members commented on the rule change. Republican Mark Uyeda criticized the change as excessive: “Today’s action solidifies the Commission’s view that the ‘dealer’ definition is almost without limit. The public should worry about the extensive reach of this claimed authority.” Hester Peirce, the other Republican on the SEC, did not make a statement.

Commissioner Caroline Crenshaw supported the changes, noting, “There’s a clear loophole here: market participants who handle a significant portion of market volume are performing dealer-like activities without the official dealer registration.”

The rules are set to be implemented 60 days after they are published in the Federal Register.