Certain traders may have engaged in speculation on the value of an incorrect token, while an adolescent trader, aged 17, alleges to have accumulated $1 million through airdrops of the authentic Jupiter token.

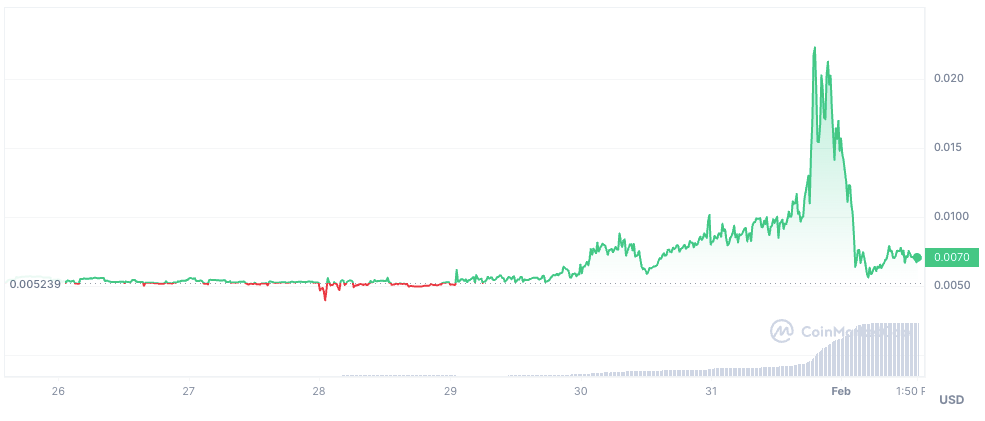

A defunct Ethereum-based protocol, inactive for seven years, experienced a momentary surge in value, possibly due to its similar ticker symbol, coinciding with the $700 million airdrop for the Solana-based exchange aggregator Jupiter. The Ethereum-based token with the same ticker saw a notable increase of over 430%, climbing from $0.005 on Jan. 30 to $0.026 on Jan. 31, before subsequently dropping to its current price of $0.007, just hours after the launch of Jupiter’s JUP airdrop on Solana.

The price of a different Jupiter protocol. Source: CoinMarketCap

Introduced in 2017, Jupiter on the Ethereum network was crafted as a protocol catering to the development and hosting of decentralized applications (DApps). Despite its inception, the official website now states that the protocol is no longer operational.

In contrast, the Jupiter platform based on Solana operates as a decentralized exchange aggregator, providing users with the capability to exchange tokens, place limit orders, and implement dollar-cost average buying strategies within the Solana network.

The notable surge in the price of Ethereum-based JUP occurred shortly before the Solana-based exchange aggregator Jupiter initiated its distribution of the approximately $700 million airdrop to early adopters.

Solana processes millions of transactions categorized as “non-vote” in a matter of hours.

Jupiter’s massive airdrop on Solana proceeded smoothly, with the Solana Foundation’s Head of Strategy, Austin Federa, confirming that the network efficiently handled 2.5 million non-vote transactions within the first two and a half hours of Jupiter claims going live. Despite a spike in Solana gas fees during the peak claiming period, Federa humorously mentioned that the fee reached an “astronomical” 0.01 SOL, approximately $1.02 at current prices. He highlighted the contrast with the considerably higher gas fees experienced by Ethereum users during popular airdrops like the ApeCoin launch in March 2022.

“If you look at like the ApeCoin airdrop, which was probably the biggest hype Ethereum airdrop, people were paying $3,500 in gas fees to claim.”

Yet, the airdrop encountered several grievances from users utilizing third-party apps like Phantom Wallet and Solflare within the initial hour. Federa clarified that the problem stemmed from remote procedure call (RPC) nodes, serving as the interface connecting user wallets and the network, rather than the fundamental layer of Solana itself.

“The base layer 1 held exactly as you would expect it to during a large influx of user activity, the RPC layer was fine — mostly unimpacted — and validators kept producing blocks in the network,” said Federa.

In the meantime, a seventeen-year-old crypto investor using the pseudonym X, also known as notshort, asserts to have accumulated more than $1 million from the JUP airdrop on Solana.

Out of all eligible wallets, 41% have currently asserted their JUP tokens. As of the airdrop’s commencement at 10:00 am Eastern Time on January 31, a total of 566 million JUP, constituting 57% of the overall airdrop allocation, has been claimed, as per Dune Analytics data from Osk2020.

More than 176,000 wallets claimed their airdrop within the first hour. Source: Dune Analytics