Emerging Trends in Financial Transactions: The Rise of Stablecoins

In the ever-evolving world of finance, a new contender is rapidly gaining ground—the stablecoin. These digital currencies, known for their stability because they are pegged to traditional assets like the US dollar or gold, are making a significant dent in the financial transactions landscape. As we delve into this trend, it is essential to explore the potential of stablecoins and their capacity to rival established financial giants such as Visa.

Stablecoins have been designed to offer the best of both worlds: the quick and borderless nature of cryptocurrencies, and the stability of traditional currencies. This unique blend makes them particularly appealing for global transactions and could explain their surging volumes, which are poised to challenge the transaction dominion of Visa.

The Comparison That Piques Interest

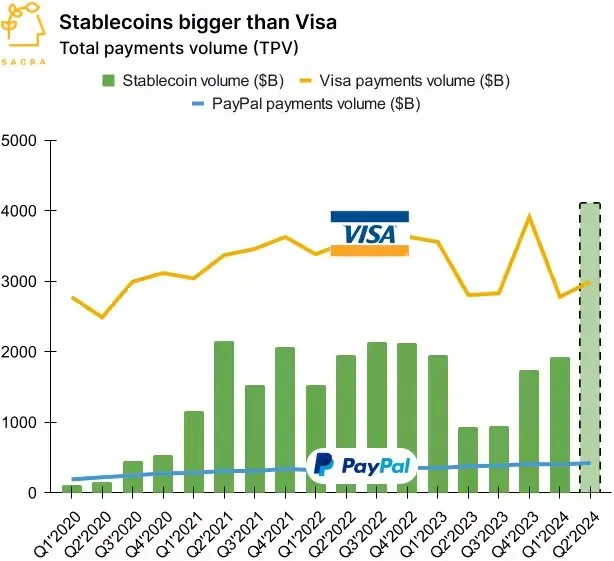

Recent data sets provide a startling perspective: stablecoin transaction volumes have soared, reaching figures that suggest they could very well be on their way to surpassing the quarterly transaction volume of a giant like Visa. Such growth is not only impressive but indicative of a broader shift in the way people around the world are choosing to transact.

For instance, consider that Visa, a household name, reported processing transactions worth approximately $2.5 trillion in a recent quarter. Stablecoins, on the other hand, have been observed to escalate rapidly to potentially matching or even overtaking this figure. This comparison is not just about numbers; it is about witnessing a historical shift in financial paradigms, where decentralized digital transactions gain equal footing with the centralized systems that have been dominant for decades.

Behind the Surge of Stablecoins

Various factors contribute to the robust growth of stablecoin volumes. Primarily, their inherent stability is a massive draw for investors and everyday users alike. Unlike their more volatile cryptocurrency counterparts, such as Bitcoin, stablecoins do not fluctuate wildly in value, making them more suitable for commerce and savings.

Moreover, the blockchain technology underpinning these digital currencies offers transparency, security, and efficiency—features that are highly appealing in a digital age where these values are increasingly prioritized. Furthermore, in regions where access to traditional banking is limited or non-existent, stablecoins provide a feasible alternative for participating in the global economy.

The Future Landscape

If stablecoins continue on their trajectory, the implications could be profound. Financial institutions like Visa might see stablecoins less as competitors and more as partners or even platforms to innovate upon. Additionally, regulators and governments around the world will have to consider the impacts of such currencies on global economics and possibly, monetary policies.

As we look toward a digital financial future, understanding and adapting to tools like stablecoins will be crucial. Whether they will overtower giants like Visa remains to be seen, but their potential to do so already marks a milestone in the journey of digital finance. This evolving narrative not only encapsulates the dramatic rise of stablecoins but also underscores the transformative power of technology in reshaping our financial systems.

In conclusion, as stablecoins forge a path towards potentially eclipsing traditional transaction methods, their journey offers invaluable insights into the dynamic nature of global finance. Their climb is more than a mere statistic; it is a testament to the shifting tides of economic exchange and the digital revolution reshaping how we think about money’s stability and utility.