Emerging markets, including the crypto sector, undergo a maturation process over time. According to Michael Nadeau, the founder of The DeFi Report, the upcoming phase will prioritize fundamental metrics, and an improvement in data quality will be a catalyst for this transformation.

Emerging markets, including the crypto sector, undergo a maturation process over time. According to Michael Nadeau, the founder of The DeFi Report, the upcoming phase will prioritize fundamental metrics, and an improvement in data quality will be a catalyst for this transformation.

“In the short run, the market is a voting machine. But in the long-run, the market is a weighing machine.” This wisdom was shared by Benjamin Graham, the trailblazer of value investing. Graham’s inaugural book, “Security Analysis,” made its debut in 1934—closely following the enactment of the Securities Act of 1933 and the Securities Exchange Act of 1934, which were established in response to the stock market collapse and the Great Depression. Graham’s contributions played a pivotal role in laying the groundwork for fundamental analysis and introducing key concepts like intrinsic value. This groundwork sowed the seeds for the market to reach a consensus on the optimal methods for valuing equities and conducting comparative analyses.

These principles gained widespread popularity in the 1950s and 60s, notably championed by Warren Buffett following Graham’s release of his second book, “The Intelligent Investor.” The broader adoption of these ideas took place within academic and corporate circles, solidifying them in mainstream awareness during the 70s, 80s, and 90s as the market coalesced around financial data and fundamental metrics such as the price-to-earnings ratio. Terms like “price to book,” “dividend yield,” “debt to equity,” “free cash flow,” “return on equity,” and “net margins” matured during this period. This era also gave rise to investing concepts like “economic moats” and “durable competitive advantages.” Crucial to this evolution was the availability of high-quality data. Without this foundational data, stocks would be susceptible to trading based on speculation, narratives, and brand value. Interestingly, this narrative draws parallels with the current state of the crypto market.

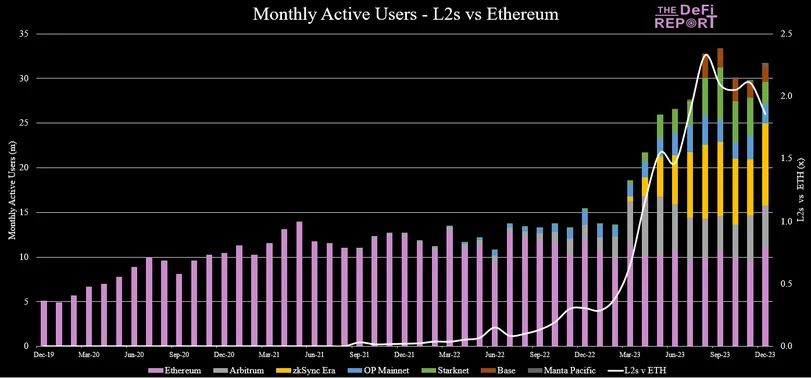

This phenomenon is unfolding in the current era of Blockchain Technology or Web3, which is embedding a fresh data layer into the internet. This new layer introduces the idea of shared global accounting ledgers and digital property rights. As an illustration, we can examine the number of active users on Ethereum L1 compared to its leading L2 networks:

This information could be utilized to estimate the anticipated value accumulation at the L2 versus L1 level within the Ethereum ecosystem. Additionally, we can observe Ethereum’s “GDP,” representing the total fees generated by the major protocols and applications constructed on the L1 infrastructure

As the comprehension of fundamental analysis for crypto networks advances alongside enhanced and novel data sources, we can anticipate the forthcoming surge of “smart money” gravitating toward the most high-caliber projects. Establishing an edge in investments will necessitate access to top-notch data ahead of the broader market. This not only provides regulators with essential tools for market monitoring but also facilitates the creation of judicious new rules for investor protection. Indeed, the granularity and nearly instantaneous delivery of data within crypto networks represent an unprecedented development in the financial realm. The future landscape of crypto investing is poised to be built upon fundamentals, with quality on-chain data serving as the cornerstone.