The European Commission is expressing disapproval of Bitcoin and contemplating stricter measures against mining activities. A recent report features strong criticism of digital assets, and EU regulatory authorities may take steps to limit the electricity provision to Bitcoin mining facilities within the bloc.

On January 31, Daniel Batten, a crypto environmentalist and venture capital investor, shared a portion of a report from the European Commission outlining its intentions to restrict the cryptocurrency sector.

EU Planning on Bitcoin Ban?

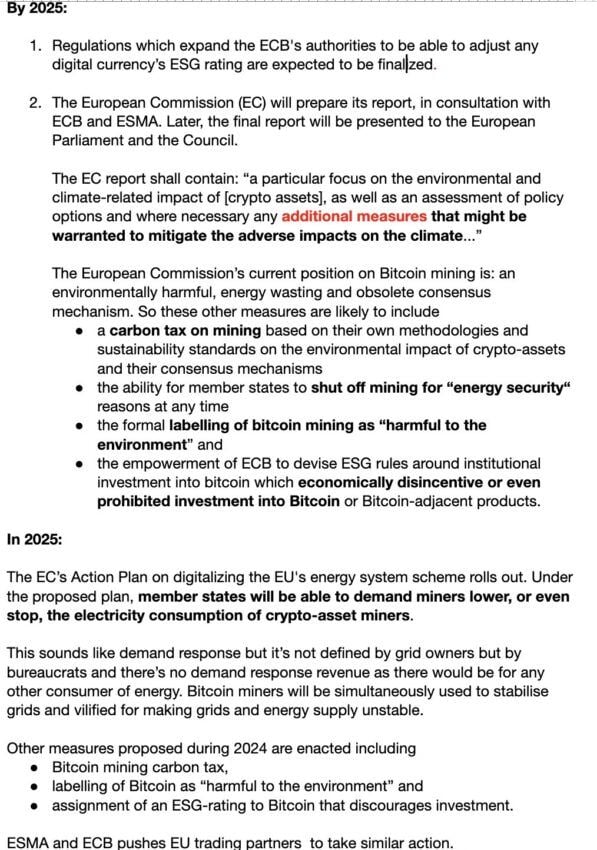

As outlined in a section of the report that has been shared, it sets the stage for a de facto prohibition on Bitcoin mining in the EU by 2025.

“While we were sleeping, the European Commission has been creating a report which they plan to label Bitcoin environmentally harmful, a threat to EU energy security, and a haven for financial criminals.”

As per the report (unverified source), the European Central Bank (ECB) and European Securities and Markets Authority (ESMA) are leading the efforts for a regulatory clampdown.

The European Commission’s existing stance on Bitcoin mining characterizes it as…

“Environmentally harmful, energy-wasting, and obsolete consensus mechanism.”

It suggests further steps to limit mining operations. These encompass the introduction of carbon taxes and granting EU member states the authority to disconnect power to Bitcoin miners for “energy security” concerns. Moreover, it aims to officially categorize BTC as environmentally detrimental.

Screenshot from EC report. Source: X/@DSBatten

It will grant the ECB the authority to formulate ESG (Environmental, Social, and Governance) regulations regarding institutional investment in Bitcoin. The central bank will implement economic disincentives or potentially “prohibit investment into Bitcoin” and associated products.

In essence, the European Central Bank might leverage its influence to essentially outlaw Bitcoin for EU members.

Batten mentioned that the founders of the Open Dialogue Foundation, Lyuda Kozlovska and Bota Jardemalie, have undertaken the arduous task. They have meticulously examined every European Commission document and have been actively opposing these developments for a period of 18 months, he noted.

He warned that this move might establish a precedent for other countries. The ESMA, which collaborates closely with the ECB, has indicated that once the report gains acceptance in the EU – “they will push for it to become the standard in other nations.”

“Like other wars, this war starts in the EU but may not end there.”

He mentioned that the EU Central Bank possesses the resources, legal process expertise, and a track record of “peer-reviewed misinformation” regarding Bitcoin’s environmental impact.

Earlier this week, BeInCrypto highlighted a UN study on Bitcoin mining that faced criticism for relying on outdated sources and exhibiting selective bias.

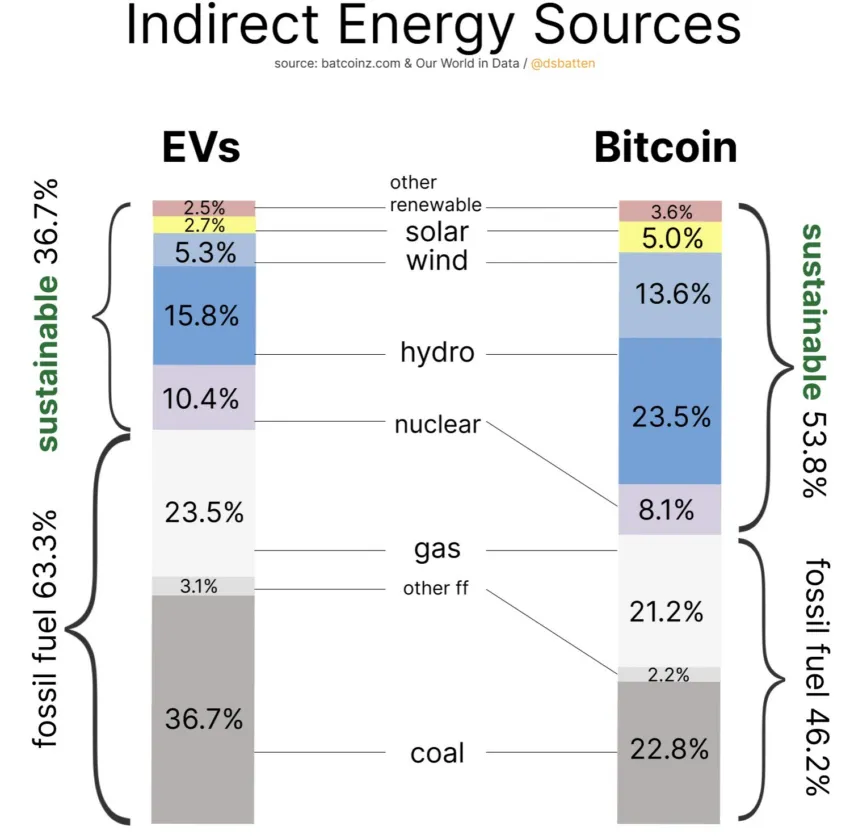

Furthermore, the FUD (Fear, Uncertainty, Doubt) surrounding Bitcoin’s environmental impact has been debunked multiple times in recent months. Additionally, the proportion of renewable energy utilized in global Bitcoin mining operations is on a rising trend.

Indirect energy sources; Bitcoin mining vs. electric vehicles. Source: Daniel Batten

Earlier this week, BeInCrypto highlighted a UN study on Bitcoin mining that faced criticism for relying on outdated sources and exhibiting selective bias.

Furthermore, the FUD (Fear, Uncertainty, Doubt) surrounding Bitcoin’s environmental impact has been debunked multiple times in recent months. Additionally, the proportion of renewable energy utilized in global Bitcoin mining operations is on a rising trend.

Nevertheless, central bankers will continue to wave the red flag at decentralized crypto assets as they continue to push CBDC plans.