Cashing in on cryptocurrency airdrops can be an exhilarating way to earn extra coins, but remember, not every airdrop is a goldmine.

Understanding Cryptocurrency Airdrops

Cryptocurrency airdrops are a marketing strategy where crypto projects distribute free coins or tokens to specific wallet addresses. This strategy helps users expand their crypto portfolios without any extra cost and can potentially earn them money as the value of these tokens increases over time.

Airdrops serve multiple purposes. Primarily, they generate buzz around a new project or cryptocurrency. By distributing free tokens, companies can quickly spread awareness and grow their user base. Additionally, airdrops can enhance liquidity as more users start trading the new tokens. They also reward loyal users and encourage community participation, fostering a sense of engagement with the project.

To participate in an airdrop, individuals often need to engage in specific activities, such as following the project on social media, owning a particular cryptocurrency, or interacting with the project’s community. While the value of airdrops is typically modest—often under $10—they can lack liquidity. Some users might sell off the coins immediately, potentially driving down the price.

How to Find Cryptocurrency Airdrops

Airdrop opportunities are usually announced publicly to create excitement and interest in a particular token or project. Joining project newsletters, social media communities on platforms like Twitter, Telegram, and Discord, and keeping up with official project updates are great ways to discover these opportunities.

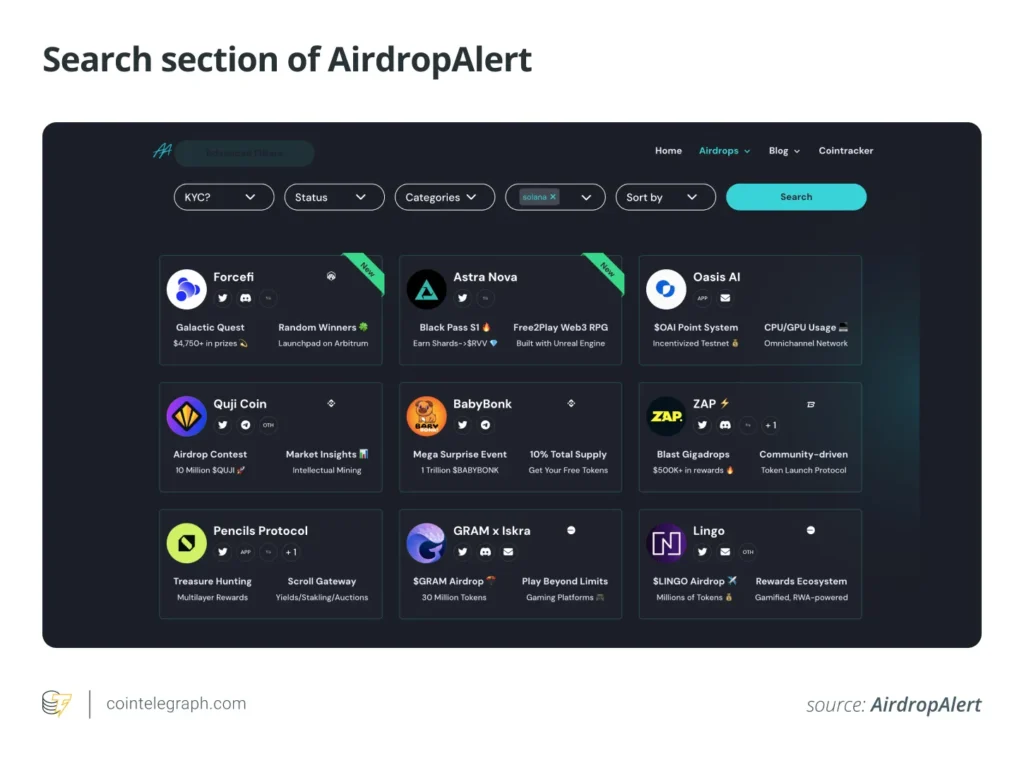

Websites such as CoinMarketCap, DappRadar, and AirdropAlert provide alerts and streamline the process of finding high-potential airdrops. Utilizing these tools can significantly increase the chances of discovering lucrative airdrops before they become widely known.

Step-by-Step Guide to Generating Passive Income with Airdrops

Generating passive income through airdrops involves following a few essential steps to ensure eligibility and secure your assets.

Step 1: Follow Airdrop Eligibility Criteria

Adhere to the specific instructions for participating in the chosen airdrop, including meeting any eligibility criteria, such as holding a minimum amount of a certain cryptocurrency. Verify the event’s duration and any other conditions for participation.

Step 2: Choose a Secure Wallet

Ensure your wallet is compatible with the blockchain network of the airdropped tokens. Many airdrops require Ethereum-based wallets like MetaMask. Consider setting up a separate wallet dedicated to airdrops to keep your primary investments secure.

Step 3: Complete Tasks

Most airdrops require participants to perform tasks such as following social media accounts, retweeting posts, creating videos, or engaging in forum discussions. Follow the specific rules of each airdrop campaign meticulously.

Step 4: Verify Participation

Some airdrops necessitate additional verification procedures, including completing a Know Your Customer (KYC) step. Exercise caution when providing personal information and confirm the project’s legitimacy.

Step 5: Collect Tokens

Monitor token distribution dates closely, ensuring any communication regarding token distribution comes from official sources. Verify contract addresses or instructions through the project’s website and official channels.

Step 6: Transfer Tokens

Once you receive a sizable amount of tokens, consider transferring them to a more secure wallet, such as a hardware wallet, to protect against potential hacks.

Maximizing Income with Cryptocurrency Airdrops

To maximize income from airdrops, participants can employ several strategies beyond standard participation.

Use Multiple Wallets

Creating multiple wallets or accounts allows for participation in an airdrop multiple times, increasing the chances of receiving more tokens. However, be aware that some airdrops limit participation to one per account.

Utilize Referral Codes

Many campaigns offer additional tokens for referrals and social media promotions. Sharing referral links can enhance your airdrop earnings.

Engage in Looping

Looping involves lending crypto to a protocol, borrowing against it, and restaking the borrowed assets. This process can increase leverage and accrue more points, maximizing airdrop rewards.

Target Ecosystem Protocols

Identifying foundational protocols for new ecosystems can be lucrative, as these often grant airdrops to stakers. Such protocols are prime targets for maximizing rewards.

Hold Tokens

Holding and accumulating airdropped tokens can yield significant returns, especially if the token gains popularity and its market price rises.

Participate in Staking and Yield Farming

Staking tokens on designated platforms and participating in yield farming can generate additional income through rewards and governance participation.

Are Cryptocurrency Airdrops Taxable?

In most jurisdictions, including the United States, Australia, and the United Kingdom, airdropped tokens are considered taxable income. The taxable amount is usually the cryptocurrency’s value at the time of the airdrop. When these tokens are sold, capital gains tax may also apply, potentially leading to double taxation.

Conversely, countries like Canada and Germany may not treat airdrops as taxable income under certain conditions. It’s crucial to be aware of local tax laws to ensure compliance and proper tax management.

By following these guidelines and strategies, you can effectively generate and maximize passive income through cryptocurrency airdrops while staying compliant with relevant tax regulations.