Hong Kong’s SFC Introduces Crypto OTC Licensing Regime

In a decisive move to better regulate the burgeoning cryptocurrency sector, the Hong Kong Securities and Futures Commission (SFC) has unveiled a comprehensive licensing framework targeting over-the-counter (OTC) cryptocurrency platforms. This new regime marks a significant step toward establishing robust oversight and transparency in one of Asia’s most dynamic financial hubs.

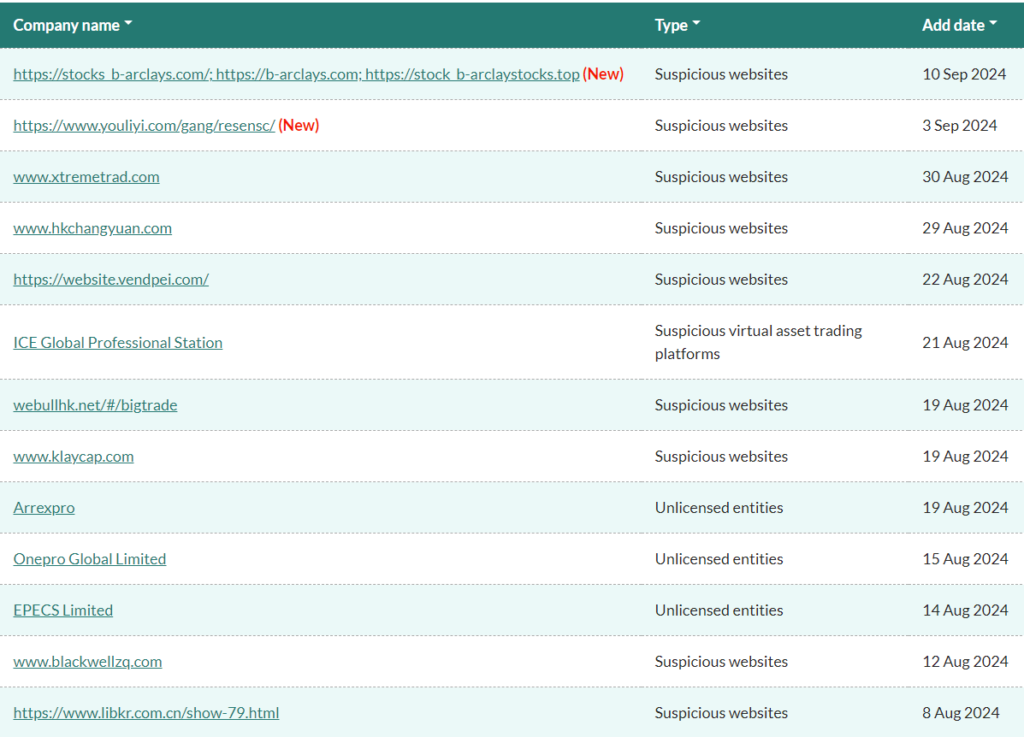

At the heart of this initiative is the drive to mitigate the risks associated with OTC crypto trading, a sphere that, until now, has largely operated in the shadows of financial regulation. By mandating that all OTC platforms procure an SFC license, Hong Kong aims to bring order to what has been a regulatory gray area. The SFC envisions this framework fostering a safer environment for investors, ensuring that only compliant and accountable entities engage in such transactions.

Julia Leung, SFC’s chief executive, emphasized the importance of this regulatory milestone, stating, “This licensing regime will ensure that crypto trading platforms operate under sound and effective regulatory standards, protecting investors while fostering market integrity.” Her comments underscore the regulator’s dual mission of safeguarding investor interests and maintaining the sector’s integrity.

The contours of the regime are meticulously outlined, requiring OTC platforms to adhere to stringent operational guidelines. These encompass a variety of criteria, including thorough due diligence processes, robust anti-money laundering measures, and comprehensive risk management frameworks. By instituting such standards, the SFC aims to weed out bad actors and ensure that only those entities with impeccable operational protocols continue to operate.

One of the key facets of the regime is its emphasis on client asset protection. The SFC mandates that OTC platforms segregate client assets from their own funds, thereby guaranteeing that customer holdings are shielded against potential business insolvencies or malpractices. This stipulation not only enhances investor confidence but also aligns with global best practices in financial regulation.

John Ho, a financial analyst at a major investment firm, remarked on the potential long-term benefits of this policy, noting, “By enforcing such detailed regulations, the SFC is setting the stage for a more transparent and secure crypto market, which could attract substantial institutional investment to Hong Kong’s financial landscape.” His insights reflect a broader industry sentiment that regulatory clarity is pivotal for sustained growth and stability.

The implementation of this licensing regime is also anticipated to usher in a new era of innovation within Hong Kong’s crypto ecosystem. As regulated entities fine-tune their operational dynamics to align with SFC’s requirements, there is likely to be an uptick in trust and participation from both retail and institutional investors. The SFC’s framework is not merely a regulatory imposition but a catalyst for enhanced credibility and global competitiveness in the crypto sector.

In conclusion, Hong Kong’s SFC’s new licensing regime for OTC crypto platforms represents a landmark advancement in the regulation of digital assets. Through meticulous guidelines and a focus on investor protection, it aims to cultivate a more reliable and transparent market. As the framework takes root, it holds the potential to significantly boost Hong Kong’s standing as a leading financial center, poised for innovation and resilient growth in the evolving digital economy landscape.