Ether ETF Weekly Flow Turns Positive

After a period of sustained outflows, a new wave of investor confidence appears to be sweeping across the Ethereum market. The latest data showcases a significant upturn in the weekly flow of Ether-based Exchange Traded Funds (ETFs), indicating a positive sentiment and potential for shifting market dynamics.

The Changing Landscape of Ethereum Investments

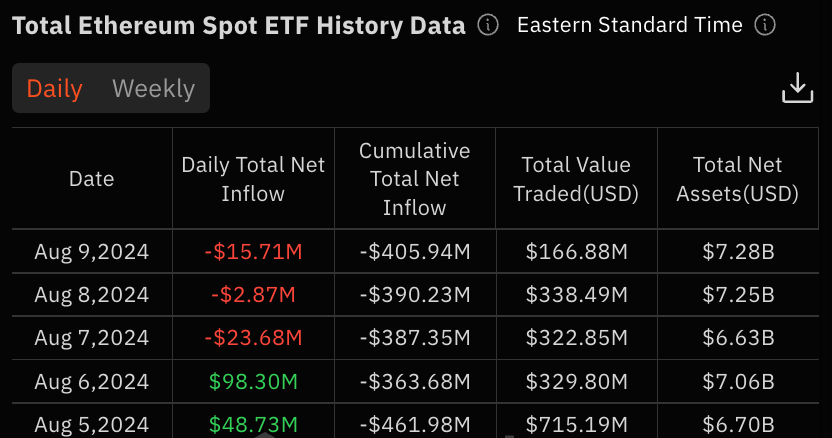

In recent weeks, the cryptocurrency market has experienced a palpable transformation. The steady stream of outflows from Ether ETFs—once a cause for concern among investors—is being replaced by a burgeoning inflow. This change is more than just a numerical shift; it represents a renewed faith in Ethereum’s underlying value and future potential.

Specifically, the weekly flow into Ether ETFs turned positive, marking a critical moment for the market. This influx of funds suggests that institutional and retail investors are increasingly seeing Ethereum as a viable, long-term investment opportunity. The reversal in the flow dynamics hints at broader acceptance and integration of Ethereum within mainstream financial instruments.

Analyzing the Flows and Market Response

The recent trend reversal in Ether ETF flows can be attributed to various factors. Firstly, the progressive rollouts of Ethereum 2.0 upgrades have captured significant attention. The promise of improved efficiency, lower gas fees, and enhanced scalability are appealing factors that potentially stabilize and bolster the network’s value proposition.

Moreover, the macroeconomic environment also plays a crucial role. As traditional markets face uncertainty, coupled with inflation concerns, investors are turning towards alternative assets. Ethereum, with its growing use-cases and robust smart contract capabilities, stands out as a formidable contender in this landscape.

Ethereum’s Growing Use-Cases and Adoption

One cannot overlook the expanding ecosystem of Ethereum in evaluating its surging popularity. From Decentralized Finance (DeFi) applications to non-fungible tokens (NFTs), Ethereum’s blockchain is at the core of some of the most innovative applications within the crypto space. This widespread adoption and versatile usage further solidify its position as a valuable digital asset.

For instance, DeFi platforms have unlocked new financial paradigms, enabling users to lend, borrow, and trade assets without intermediaries. Conversely, the NFT boom has added a unique dimension to digital ownership and creativity, using Ethereum’s blockchain to certify and exchange these tokens securely.

Institutional and Retail Interest Align

The alignment of interests between institutional and retail investors is another hallmark of this shifting dynamic. Institutions, which typically adopt a cautious approach, are now entering the fray, driven by the promise of high yields and the proven staying power of Ethereum. Concurrently, retail investors are becoming more educated and confident in their crypto asset choices.

This synchronicity is evident in the collective movement of funds into Ether ETFs, representing a blending of trust and enthusiasm that could pave the way for future growth. This synergy not only enhances liquidity but also underscores the shared belief in Ethereum’s potential among a diverse investor base.

Conclusion: A Positive Outlook for Ethereum

The current upswing in Ether ETF inflows reflects a broader optimism surrounding Ethereum’s future. As it continues to evolve and address previous limitations, the cryptocurrency appears to be on a path towards greater integration and acceptance within the financial ecosystem. With both institutional and retail investors showing renewed interest, the market’s faith in Ethereum seems stronger than ever.

This resurgence is not just a win for Ethereum but also a significant milestone for the entire cryptocurrency space, showcasing how robust technological advancements can drive value and investor confidence, leading to more stable and mature financial markets.