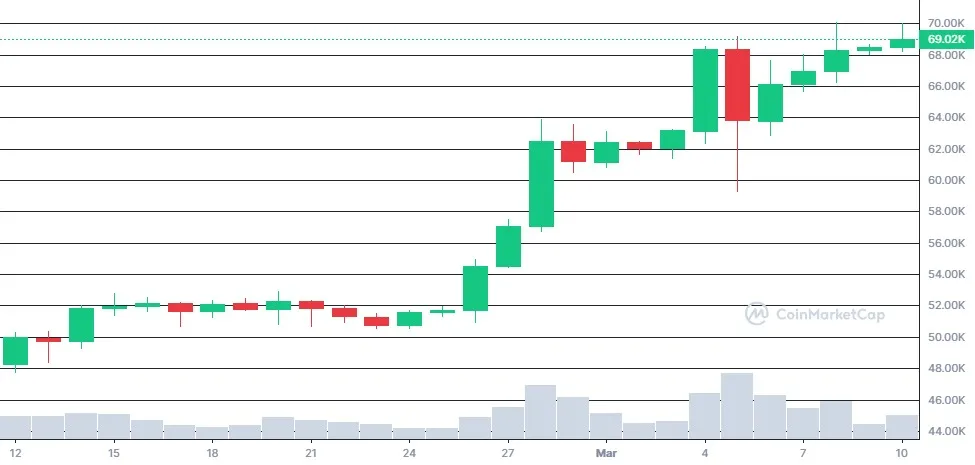

Bitcoin achieved a record-setting value of $71,415 on March 11, marking a significant milestone as it climbed 2.62% within the previous 24 hours as of 08:05 am UTC. This surge not only represents a more than 10% increase over the past week but also a remarkable 47% upswing in the last month, as per CoinMarketCap statistics. The climb to this new peak happened just three days following Ether’s leap over the $4,000 threshold, a figure not seen since December 2021.

The ascendancy of Bitcoin to this historic high occurs 36 days before the eagerly awaited Bitcoin halving event scheduled for April 20. This event will halve the rewards for mining from 6.25 BTC ($418,800) to 3.125 BTC ($209,400).

Furthermore, Bitcoin notched its highest weekly close ever at $68,955 on March 10, shortly after surpassing its former record of $69,200 on March 5.

In related news, the buoyant trend in Bitcoin’s market is largely driven by heightened interest from institutional investors, sparked by the recent introduction of spot Bitcoin exchange-traded funds (ETFs) in the U.S. Since their inception, these ETFs have acquired 4.06% of the existing Bitcoin supply, amassing over $56.9 billion in total on-chain assets, according to Dune Analytics. At the current rate, it is estimated that ETFs will secure 8.65% of the total BTC supply annually.

The last week alone saw these spot Bitcoin ETFs, including notable contributions from Grayscale’s GBTC fund despite a significant outflow of over 10,200 BTC, gather a total of 33,000 BTC ($2.3 billion), based on HODL15 Capital data. Digital asset manager Bitwise anticipates a surge in institutional investment into spot Bitcoin ETFs, potentially encompassing “trillions of dollars in assets,” by the end of June, as highlighted in a March 9 investment briefing.

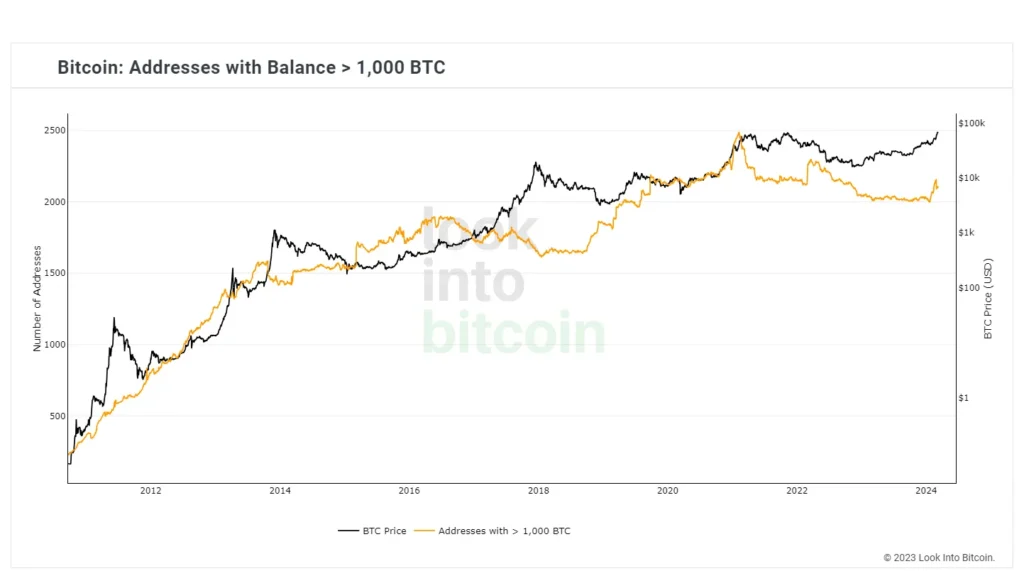

Despite the surge to new highs, Bitcoin whales, or the entities owning at least 1,000 BTC, are retaining their holdings. The count of unique addresses categorized as whales has increased to 2,107 as of March 9, although this is still below the February 2021 record of 2,489 addresses when Bitcoin’s price soared above $46,000.