Bitcoin Exchange Outflows Surge to $750 Million in September

In a significant development, the financial landscape of Bitcoin witnessed a remarkable shift in September, with an estimated $750 million worth of Bitcoin moving out of exchanges. This substantial outflow marks one of the most notable trends in the cryptocurrency market, indicating a potential shift in investor sentiment and strategy.

Understanding the Surge

The sudden spike in Bitcoin outflows from exchanges is often interpreted as a bullish sign. Typically, when investors move their Bitcoin out of exchanges, it suggests that they are opting for long-term storage solutions such as cold wallets, thus decreasing the active supply available for trading. This behavior implies a growing confidence among investors about the future value of Bitcoin, as they are choosing to hold onto their assets rather than expose them to the volatility of the exchange markets.

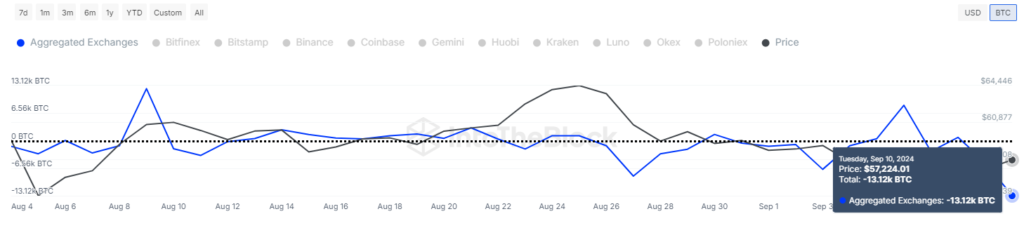

The Data Behind the Trend

CryptoQuant, a renowned blockchain analytics firm, highlighted that this outflow trend represents one of the largest movements of Bitcoin out of exchanges since the 2021 bull run. The report underscores that around 36,000 BTC were withdrawn from exchanges, a volume echoing the prelude to Bitcoin’s significant price surges in the past. Such movements are typically correlated with price increases, as a reduced supply on exchanges forms a foundation for price growth driven by FOMO (Fear of Missing Out) and market demand.

Factors at Play

Several factors contribute to this trend. For one, recent global economic uncertainties and inflation fears have rekindled interest in Bitcoin as a hedge against traditional financial instability. This is coupled with regulatory developments and growing institutional adoption, which both play pivotal roles in shaping the investment decisions surrounding Bitcoin. High-profile acquisitions and endorsements by major financial entities have also reinforced the narrative of Bitcoin as a viable long-term investment.

Market Reactions and Investor Sentiment

Market reactions to this substantial outflow have been varied. While some experts assert that it firmly signals a bullish trend, others caution that it might also represent profit-taking or strategic repositioning by sophisticated investors anticipating short-term market movements. Nevertheless, the overarching sentiment appears to lean towards optimism, reinforced by the fact that such movements traditionally preempt significant upward price actions.

Implications for Future Market Dynamics

The implications of these outflows are multifaceted. On one hand, they signify a shrinking supply of Bitcoin available on exchanges, which could lead to heightened price volatility in the short term. On the other hand, they reflect a maturation of the investor base, with more participants opting for self-custody solutions, thereby contributing to the overall stability and security of the network.

Experts believe that, moving forward, if this trend persists, it could establish a solid foundation for a sustained Bitcoin price rally. Historical patterns suggest that substantial outflows and reduced exchange balances have often set the stage for bullish market phases, driven by a scarcity-induced price increase.

In conclusion, the $750 million surge in Bitcoin exchange outflows during September is more than a mere statistical anomaly. It represents a confluence of investor confidence, economic factors, and strategic market positioning, which collectively hint at potential bullish developments in the cryptocurrency space. As always, investors and market watchers will continue to keep a close eye on these movements, seeking insights into future price trajectories and market trends.