In the dynamic world of cryptocurrency, BRC-20 tokens are currently facing a notable downturn, with market attention pivoting towards the emerging Bitcoin Runes. This shift comes just days before the much-anticipated Bitcoin halving event, sparking widespread speculation and reevaluation of investment strategies.

Major Declines for Leading BRC-20 Tokens

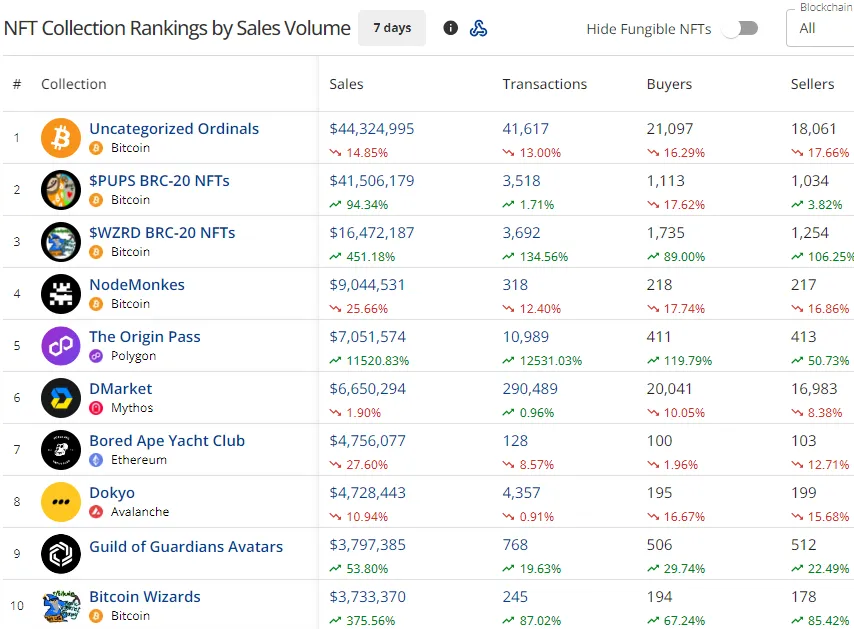

The BRC-20 tokens, particularly Ordinals (ORDI) and Sats (SATS), have witnessed substantial losses, with ORDI plummeting by over 42% and SATS by approximately 45%, according to recent CoinMarketCap data. This downturn reflects a broader trend among BRC-20 tokens, with sales of PUPS and WZRD also seeing significant declines, reported by NFT data aggregator CryptoSlam.

Surge in Bitcoin Runes Interest

Contrasting with the decline in BRC-20 tokens, the Bitcoin Runes have seen an explosive increase in daily sales volume, soaring by more than 4,500% to reach $251,000. This new token standard on the Bitcoin network facilitates the creation of fungible tokens, and its impending launch is set to coincide with the Bitcoin halving.

Market Outlook and Expert Insights

Despite the initial excitement, experts caution about the potential volatility that may follow. “Runestone, RSIC, and PUPS are already pumping, promising holders shiny new Rune token airdrops. And FOMO threads keep coming. But, like the NFT frenzy post-JPEG reveal, the market could soon cool off,” noted Ignas, a pseudonymous DeFi researcher, highlighting the speculative nature of early trading phases.

The anticipated halving event may not directly enhance the trading utility of BRC-20 tokens, potentially alienating small traders due to increased Bitcoin transaction fees. Ignas further predicts a potential dilution in the market with the launch of numerous Runes, likening their initial trading dynamics to that of memecoins.

Long-Term Prospects and Technological Advancements

Despite these challenges, there are optimistic prospects for the long-term functionality of Runes. Ignas expressed a bullish outlook, emphasizing potential future gains. Additionally, the Internet Computer Protocol (ICP) plans to integrate Runes, facilitating direct interactions between ICP smart contracts and BRC-20 tokens on Bitcoin’s base layer. This integration marks a significant step in the evolution of Bitcoin DeFi (BTCFi), aiming to enhance the utility and functionality of Bitcoin-native assets.

As the cryptocurrency landscape continues to evolve, both opportunities and risks remain prominent. Investors and traders are advised to stay informed and approach these new developments with a balanced perspective.