Binance’s Strategic Moves Towards Decentralized Exchanges and Future Prospects

In the rapidly evolving landscape of cryptocurrency, Binance, one of the industry’s biggest players, is poised to make significant strides towards decentralized exchanges (DEXs). This initiative signifies a crucial pivot in Binance’s strategy, aiming not only to diversify its offerings but also to strengthen its foothold in the decentralized finance (DeFi) sector—an area increasingly gaining prominence among crypto enthusiasts and investors.

A Strategic Investment in DEX Technology

Binance’s latest strategic move involves an investment in several decentralized exchanges. The firm’s commitment underscores its vision of promoting decentralization within the cryptocurrency ecosystem. Traditionally known for its robust centralized platform, Binance is now channeling resources to bolster DEX projects, which operate without a central authority. This shift is particularly notable given the growing concerns over security and autonomy in the crypto space, with many users seeking safer, independent trading environments.

A key aspect of Binance’s foray into DEX technology is its backing of innovative platforms. By providing substantial funding and technical expertise, Binance aims to accelerate the development and adoption of decentralized trading solutions. This move is anticipated to foster a new era of trading that is both transparent and devoid of centralized manipulation.

Looking Ahead: An Airdrop on the Horizon

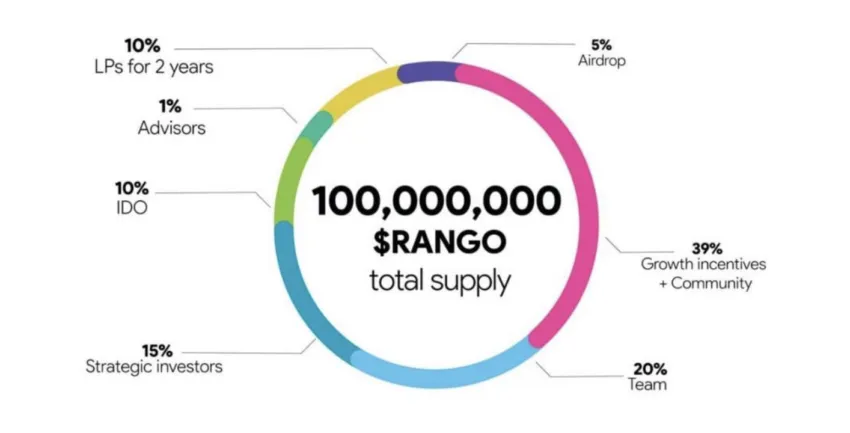

In addition to its investment in DEXs, Binance is reportedly planning a major airdrop. This airdrop, aimed to attract a broader user base, is not just a marketing strategy but a harbinger of Binance’s future intentions to enhance user engagement and adoption of DeFi practices. Airdrops typically involve distributing free tokens to current users or potential investors, thus incentivizing participation and fostering loyalty within the community.

The anticipated airdrop aligns with Binance’s broader objective of democratizing cryptocurrency access. By offering users a stake in the decentralized ecosystem, Binance is likely to see increased participation, which could result in heightened liquidity and user activity on these decentralized platforms. Moreover, this approach serves to educate the wider public about the benefits and functionalities of decentralized exchanges, thus promoting broader market understanding and acceptance.

Implications for the Crypto Market

Binance’s dual strategy of investing in DEX technology and distributing an airdrop has far-reaching implications for the broader cryptocurrency market. Firstly, this initiative underscores the growing importance of decentralization in the crypto narrative. Users and investors are increasingly valuing platforms that offer enhanced security and autonomy, which DEXs inherently provide by eliminating the risks associated with centralized control.

Additionally, Binance’s moves could potentially spur competitive innovation among other crypto exchanges. As Binance sets the pace in integrating and promoting decentralized solutions, other exchanges might feel compelled to follow suit, leading to an overall upliftment in the quality and security of trading platforms available to users globally.

Furthermore, the influx of new users drawn by the airdrop could translate into a more diversified and robust market. As decentralized platforms gain traction, they are likely to introduce a plethora of new decentralized applications (dApps) and financial products, enriching the DeFi ecosystem and presenting users with an expanded array of options for trading and financial management.

Conclusion: Adapting to the Future of Finance

As Binance embarks on this strategic journey, its commitment to decentralized exchanges signifies a forward-thinking approach in navigating the future of finance. By investing in DEX technology and planning an extensive airdrop, Binance not only reinforces its position in the market but also champions the core principles of decentralization, security, and user autonomy that the crypto community holds dear.

In essence, Binance’s initiatives represent a pivotal shift towards a more decentralized financial future, one where users have greater control over their assets and transactions. As the cryptocurrency landscape continues to evolve, Binance’s strategic endeavors will likely pave the way for broader acceptance and integration of decentralized exchange solutions, ultimately shaping the future of global finance.