Bitcoin’s journey through a $5,000 price corridor has lasted for nearly 150 days, marking a period of notable steadiness in its valuation. According to James Van Straten, a research and data analyst at CryptoSlate, this behavior is not just typical but expected in the early phases of a bull market for Bitcoin.

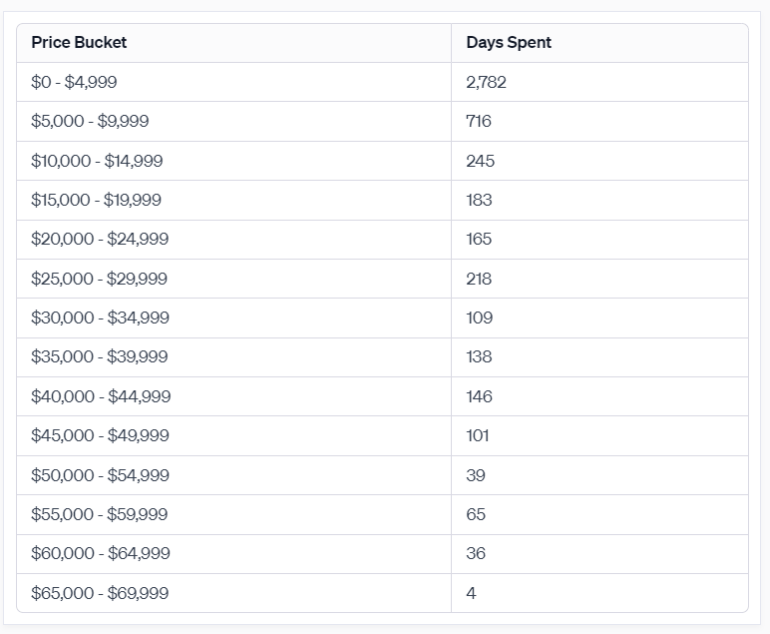

Despite achieving two-year highs earlier in 2024 and experiencing lows of $38,500, Bitcoin’s price movements have not ignited a significant trend in either direction. Instead, it has consistently traded within a $40,000 to $44,999 bracket for 146 days, overtaking its prior stretch in the $35,000 to $39,999 range, which lasted about 138 days.

Bitcoin price buckets (screenshot). Source: CryptoSlate

This range-bound trading pattern might test the patience of both bullish and bearish investors. However, Van Straten’s analysis points out that this is a characteristic behavior of Bitcoin. When looking at Bitcoin’s trading history in $10,000 increments, it’s evident that Bitcoin often spends between 100 and 250 days within these price bands. Therefore, the current trading pattern falls well within the normative behavior of Bitcoin’s historical price movements rather than being an outlier.

As the crypto market turns its attention to the upcoming block subsidy halving event, set to occur in just over two months, there’s a tempered expectation for Bitcoin’s price action. The consensus among market watchers appears to lean towards a post-halving price rally, with predictions of continued trading within the familiar ranges until then.

Michaël van de Poppe, the founder and CEO of MN Trading, shared his perspective on Bitcoin’s market dynamics. He anticipates continuing the range-bound trend between $38,000 and $48,000, a stance he has maintained for approximately two months. He suggests a possible short-term correction could be followed by a modest rally leading up to the halving, potentially pushing Bitcoin’s price towards $48,000.

“I’m still expecting a range-bound trend between $38-48K as I’ve been mentioning for ~2 months. Probably a correction in the short-term after which a slight pre-halving rally to $48K seems likely.”

BTC/USD annotated chart. Source: Michaël van de Poppe/X

Spot Bitcoin exchange-traded funds (ETFs) present a new dynamic amid these expectations. These financial instruments have started to significantly withdraw Bitcoin from circulation at a rate estimated to be ten times the daily addition of new supply. This development could be crucial in influencing Bitcoin’s price dynamics in the coming months, underscoring the multifaceted influences that continue to shape the cryptocurrency’s market trajectory.