Central Banks Ramp Up Gold Purchases to Record Levels: Here’s Why

In a remarkable yet decisive move, central banks worldwide are currently amassing gold at unprecedented levels, as underscored in recent months. This surge in gold procurement, reported by numerous financial watchdogs, signals a profound shift in monetary strategies and economic foresight.

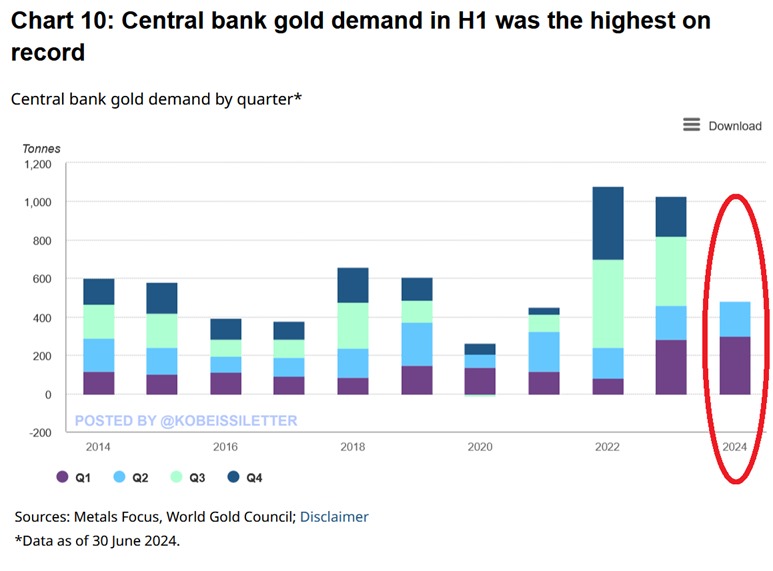

This accumulation by central banks evokes a blend of economic prudence and strategic foresight. Historically, gold has been a bastion of value, a status quo that appears resurgent in today’s economic atmosphere. According to the World Gold Council, these financial behemoths purchased a staggering 399 tonnes of gold in Q3 2023 alone, marking the largest quarterly increase since records began. Such a monumental rise showcases an inclination towards safeguarding assets against both inflation and geopolitical upheavals.

Many analysts posit that the underlying impetus behind this gold rush is multifaceted. Detractors and proponents alike point to inflation fears, volatile stock markets, and diminishing faith in fiat currencies as the triad of primary motivations. Against a backdrop of economic unpredictability, gold is emerging as a reliable safe haven. Transnational uncertainties further exacerbate this drive, fostering an environment where central banks cannot afford complacency over their reserves.

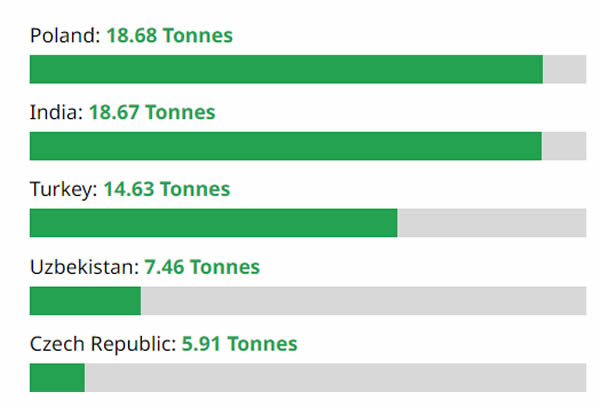

Central banks from various corners of the globe, including Turkey, Uzbekistan, and Qatar, are leading this charge, each demonstrating significant upticks in gold procurement. Turkey, in particular, acquired 31 tonnes of gold in a single quarter, ostensibly to stabilize its beleaguered lira. For Uzbekistan and Qatar, similarly large acquisitions underscore efforts to diversify holdings and minimize overreliance on the US dollar.

Experts also observe an evolving global power dynamic influencing this trend. With the ascent of emerging economies, there’s an evident desire to bolster financial sovereignty and buffer against potential Western-centric financial pressures. This self-reliance is epitomized by China’s steady accumulation of gold, a deliberate move to enhance its global financial clout and mitigate vulnerability to US monetary policies.

Delving deeper into the economic implications, this gold buying spree offers a window of wisdom into shifting fiscal paradigms. Central banks, traditionally the custodians of national treasures, are now more than ever stewards of economic resilience. The ripple effect of these acquisitions extends into the broader financial ecosystem, influencing commodity prices, forex rates, and even government policies.

To paint a broader picture, imagine the global economy as a delicate latticework, where each central bank’s decision to stockpile gold fortifies a particular node, thereby reinforcing the entire structure against systemic shocks. This analogy highlights the balancing act requisite in modern economic stewardship, one that underscores why these gold reserves are much more than mere metallic stockpiles.

The reinvigorated zeal for gold is not solely a hedge against inflation or an embodiment of financial conservatism. It reflects a nuanced recognition of gold’s intrinsic value and its role as a stabilizing force. This dynamic reshapes traditional wisdom, intertwining age-old security with contemporary monetary policies.

In conclusion, the remarkable trend of central banks augmenting their gold reserves illuminates a broader narrative of economic adaptation and strategic fortitude. As gold’s timeless allure waxes once more, this precious metal reaffirms its status as an essential linchpin in safeguarding global economic stability. Through this lens, the recent resurgence in gold acquisitions is an emblematic testament to both caution and confidence in unpredictable times.