Among the significant revelations in the world of finance and cryptocurrency, BlackRock has stood out globally with its successful deployment of a Bitcoin exchange-traded fund (ETF). This has not only significantly impacted the cryptocurrency market but also reshaped the broader financial market. Within a span of not more than two weeks, the institution’s ETF has garnered over $10 billion in assets under management (AUM), reaching a peak performance that surpasses that of the first gold SPDR.

BlackRock’s Stunning Achievement

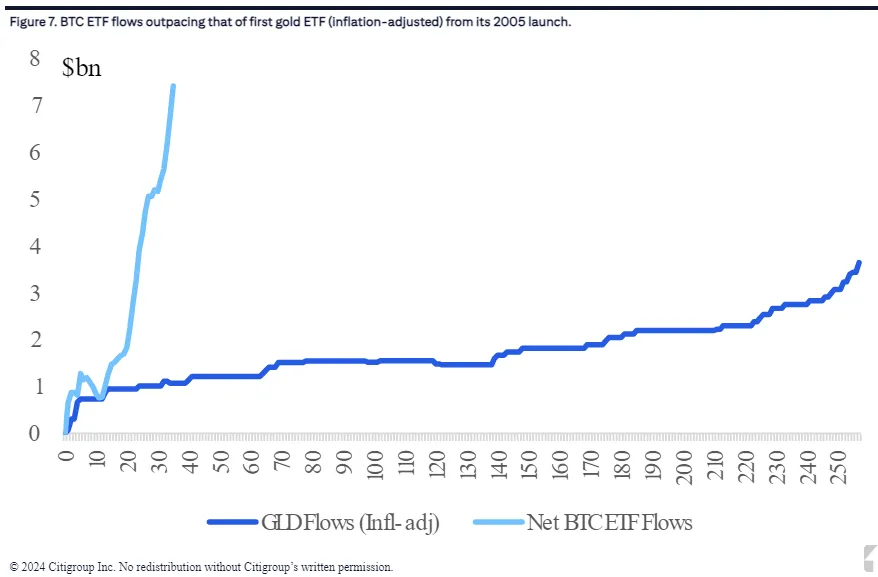

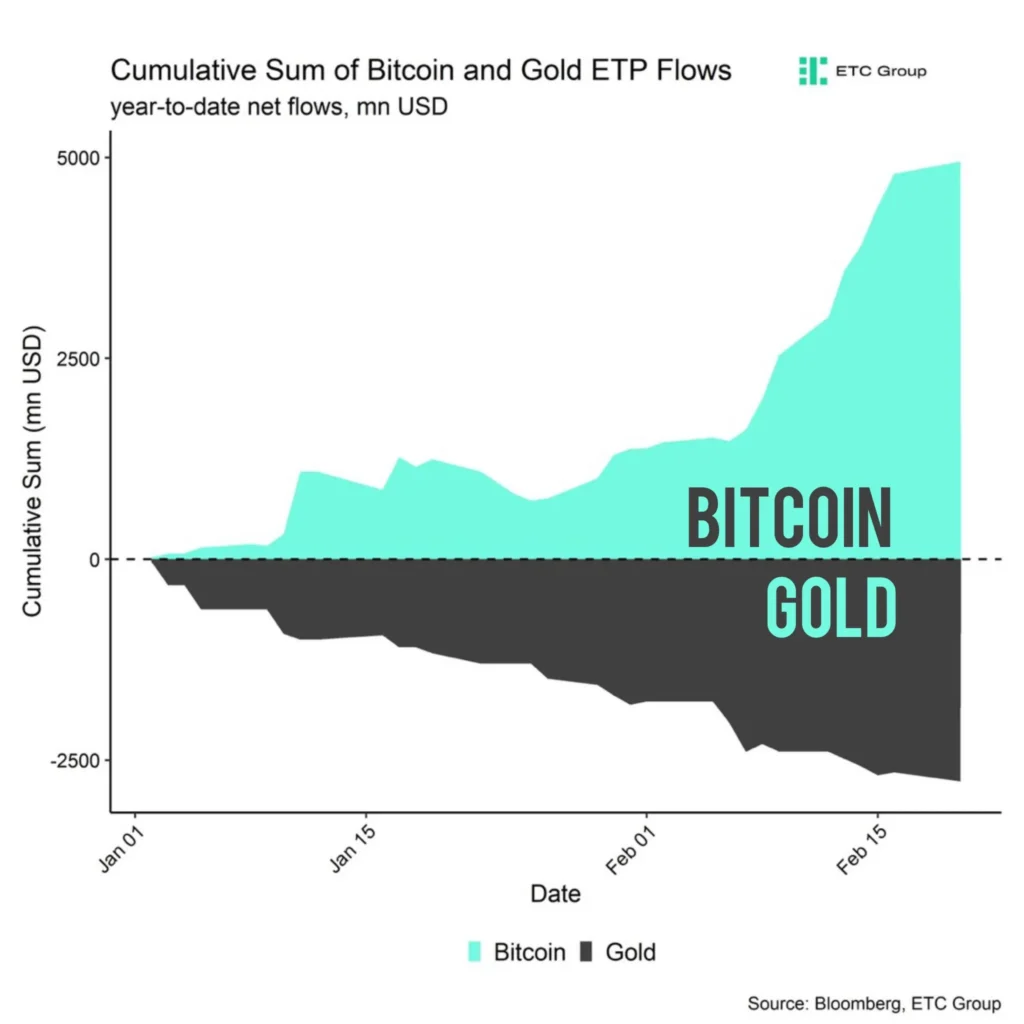

Given its recent performance, BlackRock Bitcoin ETF’s success story represents an exceptional achievement. To effectively contextualize the achievement, the ETF’s exponential increase finds similarity with the introduction of the first Gold SPDR around fifteen years ago – a milestone that effectively reshaped the commodities market. However, the BlackRock Bitcoin ETF has even outpaced the first Gold SPDR – crossing $10 billion AUM within less than two weeks while the first Gold SPDR achieved this mark in three years.

Impressive Comparison with Other Cryptocurrencies

Focusing further on the market activity, the impressive growth rate of BlackRock Bitcoin ETF presents a compelling comparison with other cryptocurrencies. For instance, the firm’s achievement outmatched Binance Coin (BNB) which took almost five years to cross the $10 billion mark. Furthermore, Ethereum, considered one of the major cryptocurrencies, attracted $10 billion AUM in almost three years, further accentuating BlackRock’s unparalleled performance. By contrast, Bitcoin, the largest cryptocurrency by market capitalization, was able to reach the mark within a year and a half. It becomes evident that BlackRock has established a bold statement, outshining several major players in the crypto industry.

The Viewpoint of Market Experts

Experts and market analysts view this event as a noteworthy evolution in the financial market. They believe that the BlackRock Bitcoin ETF has the potential to disrupt the conventional market norms. The experts further asserted that the fund’s performance can ignite a new debate on whether commodities or digital assets are a better investment. Eric Balchunas, the senior ETF analyst at Bloomberg, affirmed, “It’s like comparing S&P’s ETF debut – it’s a game-changer, it’s a big deal.”

In essence, the BlackRock Bitcoin ETF has demonstrated a disruptive potential by beating historical records and eclipsing several significant cryptocurrencies within a rather short span. The fund’s exponential growth poses a pivotal question regarding the investment landscape of commodities versus digital assets. This encourages a reevaluation of traditional market norms, thus painting a fascinating picture of the potential escalation of the crypto market.