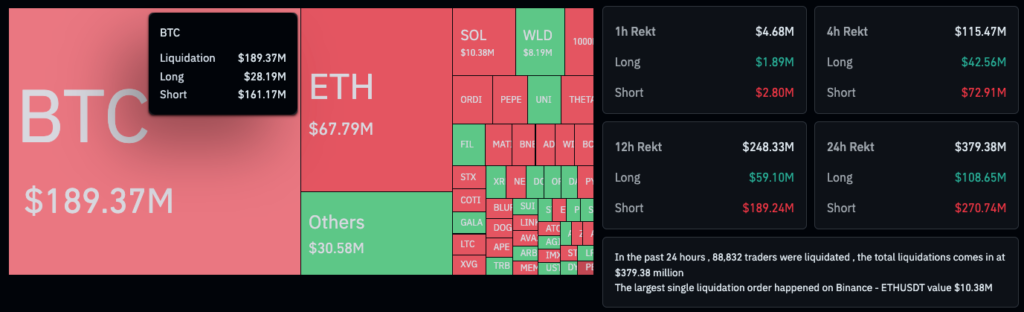

Bitcoin short sellers are facing substantial losses as Bitcoin (BTC) surged nearly 11%, reaching a new yearly high of $57,000. Data from CoinGlass indicates that over $161 million in BTC shorts were liquidated in the last 24 hours. Those attempting to short Ether (ETH) didn’t fare much better, with liquidations totaling almost $44 million within the same timeframe. The total liquidations for short positions exceeded $270 million as Bitcoin briefly touched $57,000.

More than $270 million in short positions were liquidated in the last 24 hours. Source: CoinGlass

The broader market experienced a significant uptrend led by Bitcoin, rising by 10.8% from $51,471 to $57,035 in less than 24 hours, according to TradingView data. Although Bitcoin has cooled off and is currently trading at $56,000, it still reflects a 32% increase in the last month.

Pav Hundal, Swyftx lead analyst, described the crypto market as “on fire,” attributing the surge to substantial retail trade volumes and significant institutional buying pressure. Hundal pointed out the immense volumes of institutional capital flowing into recently approved spot Bitcoin exchange-traded funds (ETFs) in the United States.

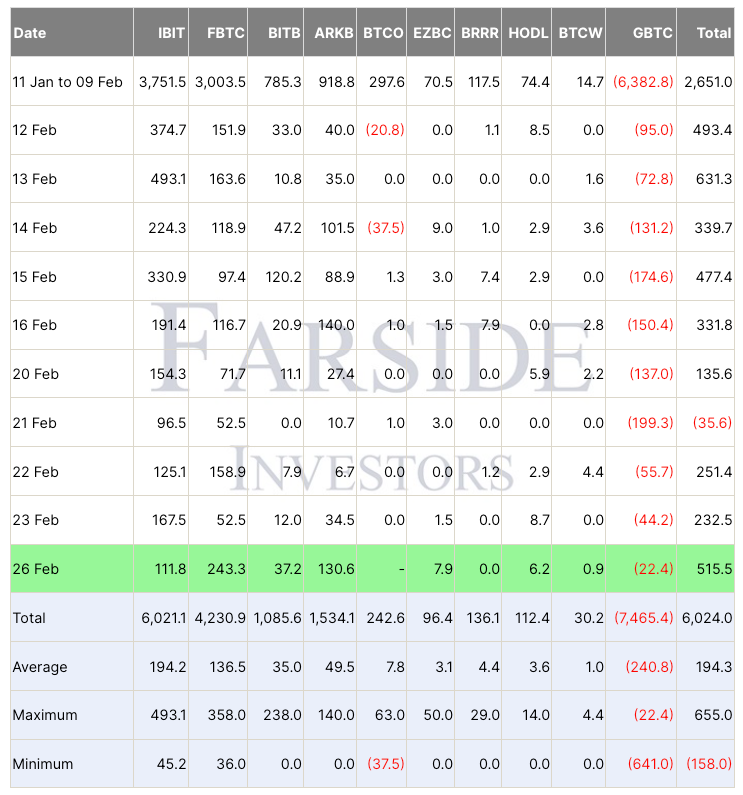

Net inflows into the 10 Bitcoin ETFs surpassed $515 million on Feb. 26, marking one of the highest days of inflows since the ETFs were approved on Jan. 11, according to Farside data. Hundal noted, “Exchange Traded Funds alone are cannibalizing close to a quarter of the Bitcoin that is currently being produced by the network.”

Bitcoin ETFs notched $515 million in daily inflows on Feb. 26. Source: Farside Investors

Market pundits on social media echoed enthusiasm for the future price of Bitcoin. Co-founder of Gemini exchange, Tyler Winklevoss stated, “We’re so back!” while BTC bull Dan Held proclaimed that the current price action marked “the beginning of the Bitcoin bull run.”