The Reality Behind the Value of Crypto AI Tokens: A Comprehensive Study by Coinbase Research

In an intriguing deep dive into the world of Crypto AI tokens, research spearheaded by Coinbase has revealed some surprising insights. Despite high expectations and speculation, it appears that the valuation of these tokens might not be as robust as originally believed. The study suggests that the value attached to noteworthy crypto AI tokens may be much higher than what it should be in reality, creating a seemingly inflated market.

Our exploration into the research findings begins by deliberating on the very definition of AI. Artificial Intelligence, commonly known as AI, has seen a significant surge in popularity over the past decade. Characterized by its ability to mimic human cognition and perform tasks that ordinarily require human intellect, AI has permeated almost every industry, leading to the creation of dedicated tokens in the crypto sphere.

However, moving past the surface-level fascination with AI technology, Coinbase’s investigation unveils a different story. The research asserts that despite AI being presented as the primary feature of these tokens, real-world usage relating to Artificial Intelligence is rather minimal. For instance, the findings underscore the presence of a mere 1% of AI code within the AI-labeled crypto projects under examination. “There is less AI code in AI Crypto projects than one might expect.” This remarkable observation implies that while AI may be a key selling point of these projects, it doesn’t contribute significantly to the underlying technology.

Delving further, the report points out the reasons why these observations matter to the crypto trading community. Based on these findings, investors who speculate on the future potential of these tokens might not be privy to the whole truth about the limited AI integration. As a result, they may overestimate the value and market potential of the AI tokens, leading to overpricing.

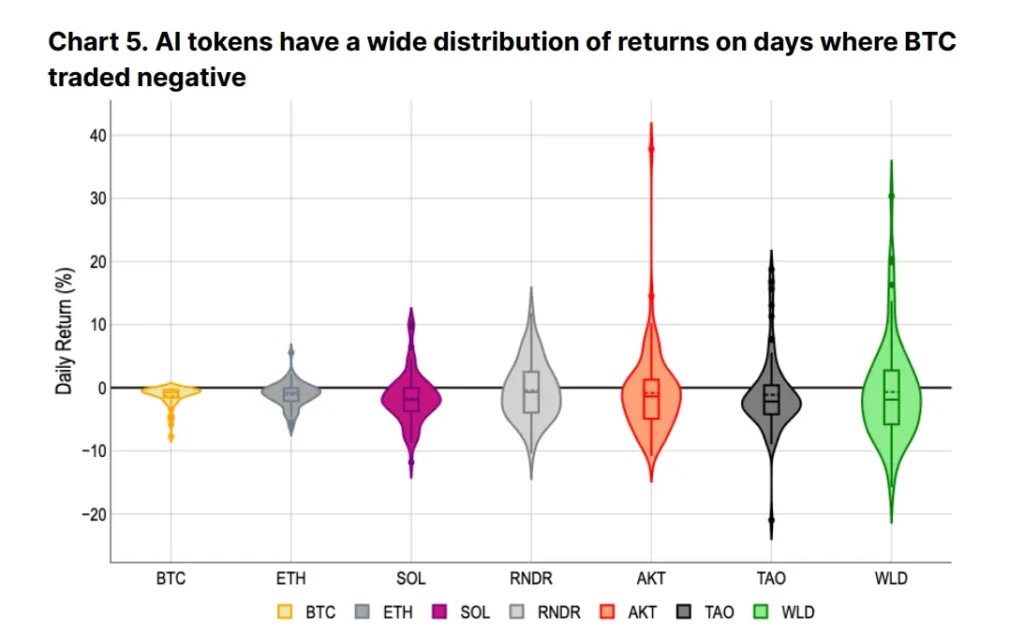

The research also highlights the tightrope walked by AI crypto projects. While the dependence on a single high-value token has its advantages such as liquidity and compatibility, it also exposes the project to the risks of volatility, increasing the chances of unexpected price fluctuations.

Concluding on a cautionary note, the study invokes a call to action for the crypto community, emphasizing the need for more extensive review and scrutiny of AI labeling in crypto projects. After all, as the research indicates, an overestimated valuation of crypto AI tokens could negatively impact investors.

These insightful findings from Coinbase’s research function serve as an essential reminder for everyone in the crypto sphere: truth and transparency should always be the cornerstones of any investment decision. Being informed and taking the time to thoroughly inspect the project you intend to invest in is invaluable, irrespective of the glossy AI labeling that may be attached to it.

Maintaining high standards of due diligence can help crypto investors navigate the often turbulent waters of the cryptocurrency market with more confidence and hopefully, with fewer surprises along the way!