In a milestone move that could reverberate throughout the fintech world, Singapore has recently updated its Payment Services Act. The new amendments aim to create a more inclusive, robust regulatory environment and stronghold for various digital payment services and crypto practitioners within the island nation.

The legislature, which was revised in January 2020, provides a forward-thinking and expansive blueprint for digital payment token services. Historically, the focus has been predominantly on safeguarding against money laundering and terrorist financing. Importantly, though, the Act also serves a strategic role, paving the way for a more progressive and inclusive crypto ecosystem.

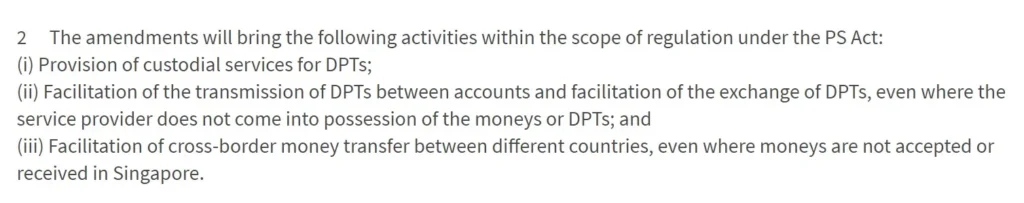

Let’s delve into the fascinating changes that this amendment has brought about, and how it impacts both consumers and providers. Focusing on the invigorated landscape for digital payment token service providers, the updated Act brings new obligations. Under these regulations, they must be licensed, promoting a safer, more trustworthy environment for consumers. It’s a game-changing alteration necessary in an industry that is still often viewed with suspicion.

However, new privileges come with new responsibilities. As a condition for obtaining these licenses, providers now have to strictly abide by a compliance checklist. These requirements ensure that they uphold their role in preventing crimes such as terrorism financing and money laundering.

Reflecting on the significance of this regulatory milestone, Loo Siew Yee, the Assistant Managing Director at the Monetary Authority of Singapore (MAS), cited the Act’s importance in boosting consumer protection while promoting confidence in the use of e-payments. “The Payment Services Act provides a forward-looking and flexible regulatory framework for the payments industry,” said Yee. “The activity-based and risk-focused regulatory structure allows rules to be applied proportionately and to be robust to changing business models.”

By fostering a favourable regulatory climate, the Singapore government is keen on drawing more global fintech companies to its shores. The new Act offers not only a more regulated environment but also gives firms a more level playing field. The comprehensive nature of the legislation means that every provider — large or small — is bound by the same rules and obligations.

Through the progressive regulation and forward-thinking nature of the Payment Services Act, Singapore is creating opportunities for innovation and growth. It’s hoped that the Act’s thoughtful mechanisms will bring rays of transparency to the shadows of the crypto world, ultimately buttressing Singapore’s position as a global fintech hub.