Spotlight on GBTC: Record Daily Outflow

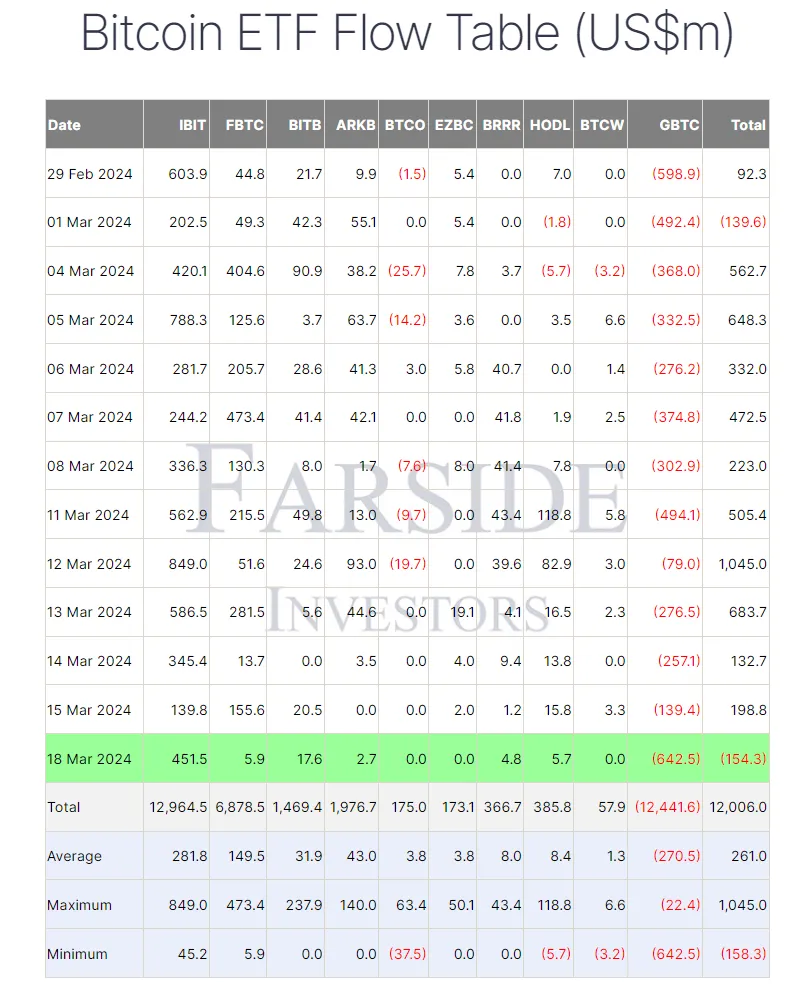

Recent trading demonstrated that the Grayscale Bitcoin Trust (GBTC) set a new record with the largest daily outflow ever recorded. According to data released, the GBTC had an outflow of around $141 million.

Grayscale: The Market Leader facing Competition

Grayscale has long maintained its title as being one of the leading companies in the world of cryptocurrency, offering users a regulated and straightforward alternative to buying Bitcoin directly. However, recent developments suggest that the spotlight may be shifting towards other competitors in the crypto market, namely Spot Bitcoin ETFs.

“GBTC has been facing stiff competition from the newly launched Canadian ETFs, which might be the reason behind this rapid outflow,” explains JPMorgan’s Global Markets Strategy team.

A Change in Investors’ Preferences

The numbers don’t lie: investors seem to prefer Spot Bitcoin ETFs over GBTC, which might reflect a shift in the investment trends in the crypto market. Though GBTC does offer its services at a discount, Spot Bitcoin ETFs seem to be attracting more inflow. JPMorgan’s Global Markets Strategy team further elaborates, stating, “The structure of GBTC implies that outflows should be reducing the GBTC price… which is indeed what we observe.”

Overview of Spot Bitcoin ETFs

Spot Bitcoin ETFs serves as a more direct investment mechanism which provides ownership in actual Bitcoins on a 1:1 basis, rather than simply through a trust such as GBTC. As a result, Spot Bitcoin ETFs have seen a surge in interest, with investors favoring real assets over trusts.

In Conclusion

Trading activities analyzed over recent times indicate shifts in the trend and choices in the investment industry. The recent outflows from the Grayscale Bitcoin Trust (GBTC) might hint towards the potential rise and favorability of Spot Bitcoin ETFs. A mix of transparency, spite of investment freedom, and the plot of owning real assets might be the key factors attracting investors to Spot Bitcoin ETFs.