The European Parliament has passed new regulations that set specific due diligence requirements for cryptocurrency companies to help combat money laundering.

These regulations focus on enhancing “due diligence measures and identity checks” for customers, including those involved with crypto asset management. Such entities are also tasked with notifying authorities about any suspicious activities.

The legislation, which received approval on April 24, affects crypto-asset service providers (CASPs), such as centralized crypto exchanges, under the Markets in Crypto-Assets (MiCA) framework and other sectors including gambling services.

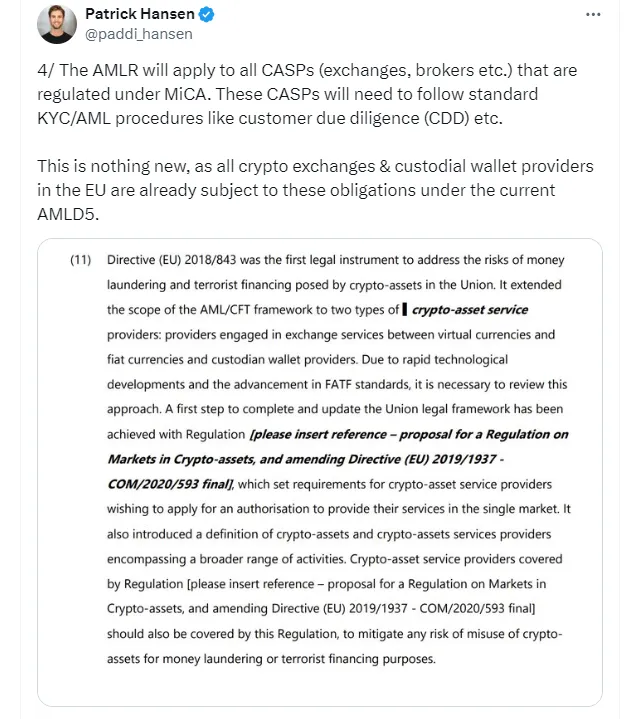

Source: Patrick Hansen

Introduced by the European Union in June 2023, MiCA is a regulatory framework designed to govern digital assets and their marketplaces. It is set to be fully implemented by the end of this year.

An announcement has been made about a new body, the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA), which will oversee the enforcement of this new rule.

The headquarters of AMLA will be located in Frankfurt, Germany. However, the law still needs formal approval by the Council and publication in the EU Office Journal.

Patrick Hansen, the EU strategy and policy director at Circle, shared his enthusiasm for the outcome of the vote in a post on X, noting that the measure is expected to be formally adopted by the Council of the EU and will come into effect three years later.

Hansen also mentioned that these CASPs will need to follow standard Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols like customer due diligence.

He emphasized that these requirements are not new, as all EU crypto exchanges and custodial wallet providers are already bound to these regulations under existing laws.

Describing the final version of the rule, Hansen called it a “positive result” for the cryptocurrency industry. He acknowledged that initial drafts of the proposed Anti-Money Laundering Regulation (AMLR) took a much tougher stance, which would have required KYC for transactions involving self-custody wallets. However, thanks to industry advocacy for a risk-based approach that offered multiple options, a consensus was reached.

Recently, the European Parliament’s leading committees removed the 1,000-euro ($1,080) cap on cryptocurrency payments from self-hosted wallets in the new AML legislation.