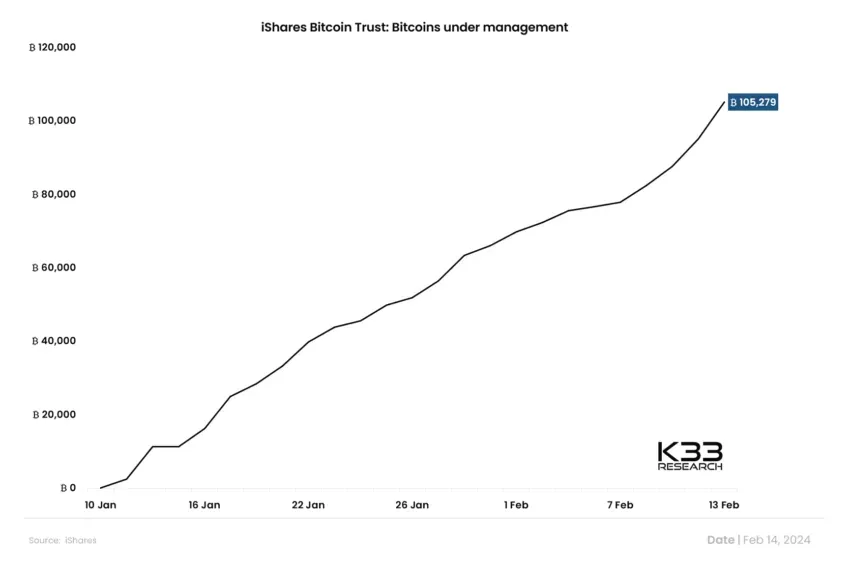

BlackRock’s Bitcoin-focused Exchange Traded Fund (ETF) has reached a new landmark, managing over 100,000 bitcoins. This achievement positions the iShares Bitcoin Trust (IBIT) as the inaugural U.S.-based Bitcoin ETF to gather more than $1 billion in assets. On February 14, Bitcoin’s value ascended beyond $51,500, showcasing a notable appreciation of 21.50% in 2024.

On the eve of February 13, the assets under management by BlackRock’s Bitcoin ETF eclipsed the 100,000 BTC mark. This event earmarked it as the premier U.S. spot Bitcoin ETF to amass over $1 billion in assets, with a significant $493.1 million of inflows recorded on that day alone, highlighting Bitcoin’s increasing acceptance among institutional investors as a credible investment class.

BlackRock’s Bitcoin Fund Sets New Benchmarks

K33 Research reports indicate that BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has successfully managed more than 100,000 bitcoins. This fund is now distinguished as the first U.S. spot Bitcoin ETF to exceed the milestone of $1 billion in assets, with an impressive $493.1 million received in a single day, February 13, surpassing its competitors like Fidelity’s FBTC which has attracted $881 million in total inflows.

Data from Farside Investors shed light on the burgeoning interest in Bitcoin ETFs, with a record-setting net inflow of $631.3 million reported on February 13. This peak in daily inflows reflects growing investor confidence in Bitcoin, positioning it as a highly sought-after investment option.

Bitcoin’s price increase to over $51,500 on February 14 underscores its strong performance in 2024, with gains of 21.50% thus far.

Anthony Pompliano, a notable investor, emphasized the surge in capital flowing into Bitcoin ETFs, with demand substantially outstripping the supply of new Bitcoin being mined, which ranges between $40 million to $45 million daily. “There’s 12.5 times more demand than supply being created every single day. This imbalance is expected to drive Bitcoin’s price higher in the forthcoming weeks,” he speculated.

Michael Saylor, a prominent advocate for Bitcoin, remains bullish on its long-term prospects, attributing the surge in capital inflows to Bitcoin’s growing allure as an investment option. He highlighted Bitcoin’s unique attributes and its detachment from traditional risk assets, alongside the role of ETFs in facilitating Bitcoin access to mainstream investors, thus fuelling a demand that significantly overshadows supply.