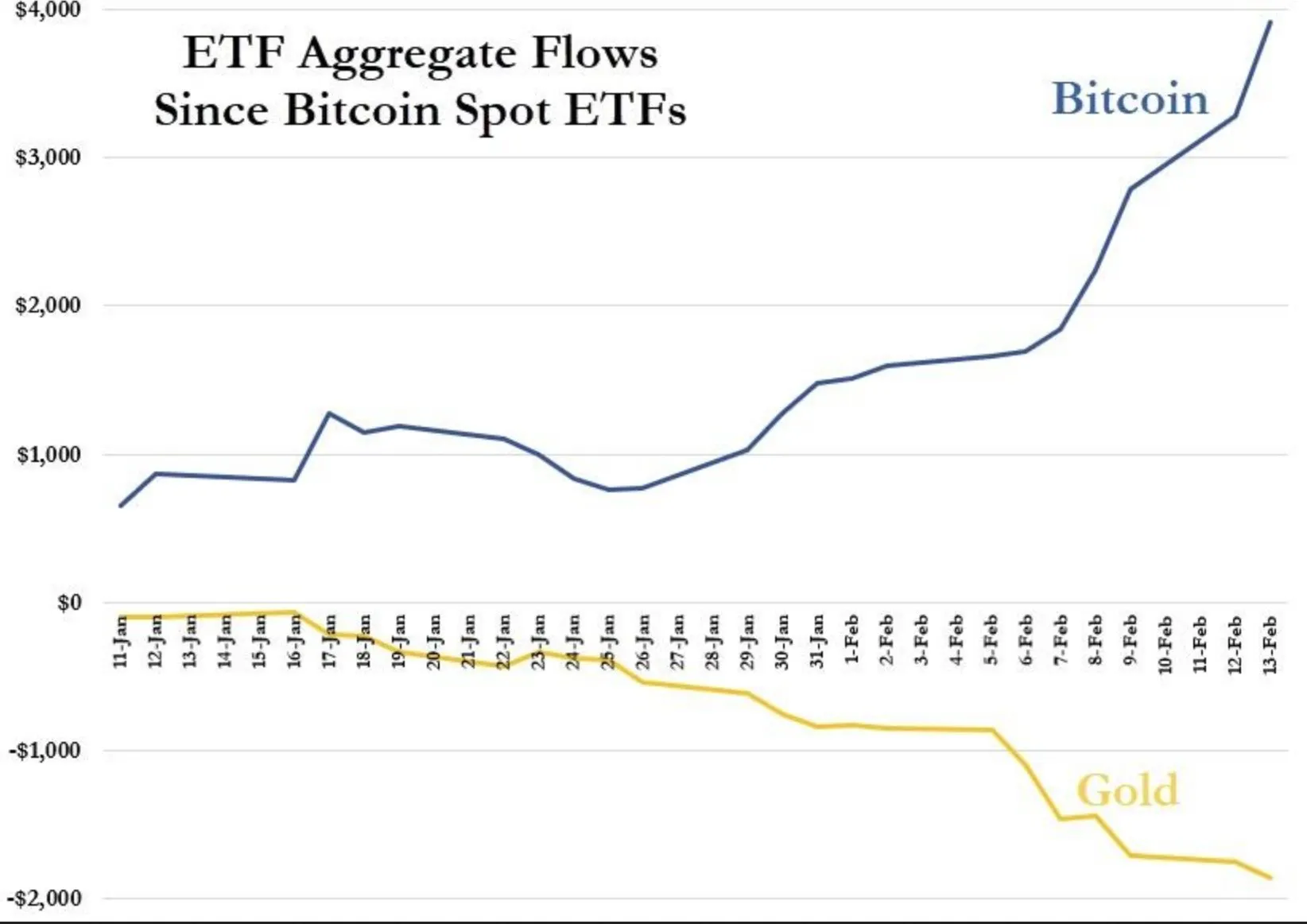

With the sudden the surge in popularity of Bitcoin ETFs, the conventional gold-backed exchange-traded funds seem to be losing their shine. As investors turn their gaze toward digital gold, the old-fashioned gold ETF market has experienced dramatic outflows throughout the year.

In 2021, the tables have turned in the financial markets as investors are increasingly preferring Bitcoin ETFs over their gold counterparts. This new-age digital asset has caught the attention of investors, and cash flow into Bitcoin has hit record-breaking volumes. The growing trust and interest in this particular kind of ETF stems from its promising return on investment, which has far outperformed gold so far.

A Struggle for Gold ETFs

Conversely, experts have observed consistent outflows from gold ETFs, indicating a clear challenge for these traditionally steadfast assets. Investors are seemingly becoming less infatuated with this classic investment tool, opting instead for the promise of high yield from growing digital currencies, such as Bitcoin.

A Paradigm Shift in Investment Strategies

The shift from traditional gold ETFs to Bitcoin ETFs signifies a changing landscape in the field of investments. It represents the beginning of a new era wherein digital assets are reshaping our understanding of wealth accumulation. This powerful swing in investment preference is also a clear indicator of Bitcoin’s resilient drive toward mainstream acceptance.

ETF aggregate flows since spot BTC ETF launch. Source X/Jameson Lopp

Final Remarks

While gold ETFs are currently experiencing a decline, the investment world is never static. It is yet to be seen if this seismic shift towards Bitcoin ETFs will become the new normal or whether gold ETFs will regain their former glory. Regardless, the growing interest in Bitcoin ETFs is a testament to the emerging significance and acceptance of digital currencies in the financial market at large.