The Potential of AI Investments and Cryptocurrency: The Dual Focus of a16z

In the modern era, venture capital giant, Andreessen Horowitz (a16z) has been maintaining a keen eye on the sectors of artificial intelligence and cryptocurrency. Despite the impactful twists and turns these industries often face, a16z remains deeply invested, steadfastly navigating the opportunities that lie ahead.

Recently, information emerged about the firm’s ambition to raise a massive fund targeted at the artificial intelligence (AI) industry. This new venture known as the a16z’s AI fund, aims to accumulate a sizable $800 million to aid in honing in on innovative startups operating in AI. The venture capital firm perceives a wealth of untapped potential within these startups and is interspersed with considerable optimism about their futuristic prospects.

While AI appears to be the firm’s primary focus, cryptocurrency isn’t lagging too far behind on their list of interests either. Despite the rapid strides the firm has made in the crypto space, recently, the ambitious crypto fund has been put on hold. The reason for this pause remains unclear, but one could conjecture that a16z is perhaps intending to focus more on their AI investments before plunging back into the unpredictable world of crypto.

Navigating Unpredictability: Crypto Investments Temporarily on Ice

An important aspect to remember about a16z’s approach towards cryptocurrency investments is its ability to navigate the unpredictable climate of these digital assets. There surely seems to be a fine strategy in tow, notably evidenced by a16z’s announcement of delaying its plans for a $2 billion crypto-focused fund.

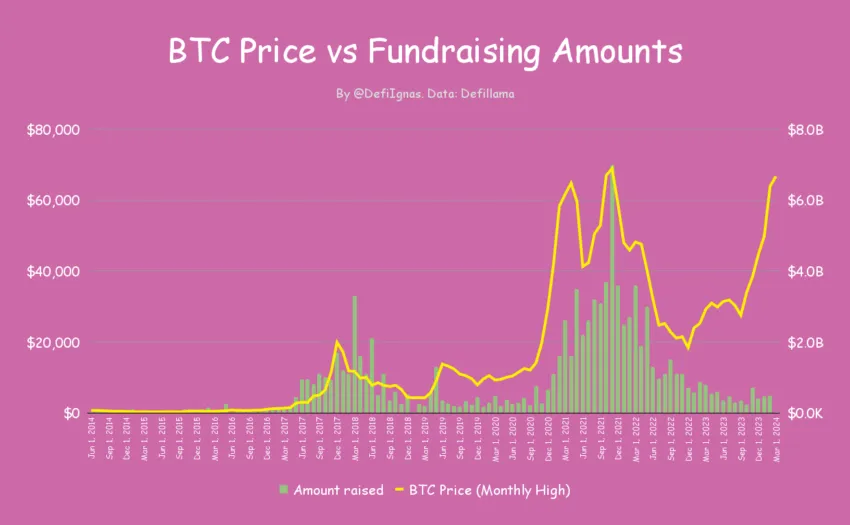

Significantly, this decision was made at a time when Bitcoin was setting record-breaking valuations, hinting at an arena rife with invigorating possibilities. Crypto veterans however, understand the pendulum motion indigenous to cryptocurrencies––with sky-high peaks often followed by drastic lows. This could be a likely reason for a16z’s thoughtful hiatus.

While the freshest timeline for the resurrection of this project remains undisclosed, a16z co-founder, Marc Andreessen, was quoted saying, “We still have commitment, we’re not negative on it [crypto]. We just have to see how the weather develops over the next few months.”

The Pivot towards AI Investments

In the interim, as their crypto endeavours take a brief preparatory pause, a16z’s attention is veering towards its AI-centric fund. They envision AI as an elemental pivot that could transform a broad spectrum of industries.

While specifics of the AI fund are still under wraps, the sheer monetary ambition of $800 million earmarked for dealing primarily with AI startups underpins the immense potential they see in the market. If everything sails smoothly, the AI fund will be marked as a16z’s third significant foray into the AI domain after the AI Frontier Fund and the AI Fund II.

With global billion-dollar companies like Microsoft and Google actively investing in AI, the fierce competition is palpable. Nevertheless, a16z, with its concentrated gaze set on AI and crypto, remains undeterred and moulded for innovative exploration.

This approach underscores the firm’s adaptive spirit, striding confidently towards the unfolding future of artificial intelligence and cryptocurrency, two domains that could redefine the world as we know it.