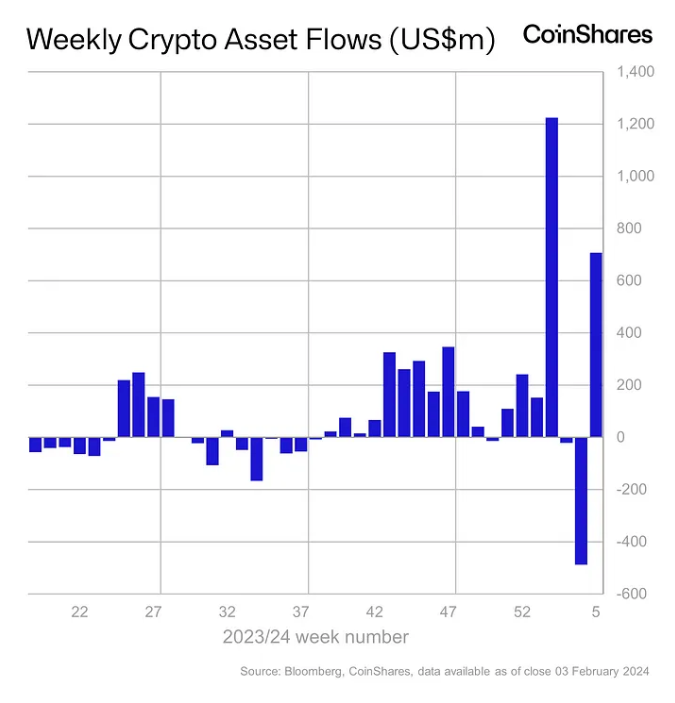

Last week, crypto funds managed by big names like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares saw a significant increase in investments, with a total of $708 million flowing in worldwide. This update comes from the latest report by CoinShares.

This recent boost in investments is one of the largest since two key events: the introduction of spot bitcoin exchange-traded funds (ETFs) in the U.S. on January 11 and the peak of the crypto market at the end of 2021. After experiencing drops in investments for two consecutive weeks, these inflows have pushed the year’s total to $1.6 billion, with overall assets under management reaching $53 billion, says James Butterfill, the head of research at CoinShares.

A notable part of this turnaround involves Grayscale’s bitcoin ETF (GBTC), which, despite its higher fees, saw a decrease in the amount of money leaving the fund. Last week, GBTC’s outflows were $927 million, a drop from $2.2 billion the week before, indicating a slowing in the rate at which investors were pulling out their money, according to Butterfill.

However, the total trading volume for these funds dipped to $8.2 billion from $10.6 billion the previous week, still significantly higher than the average weekly trading volume of $1.5 billion seen in 2023. This recent trading volume accounted for 29% of bitcoin’s entire trading volume on trusted exchanges last week, adds Butterfill.

Investment in bitcoin and U.S. ETFs stood out, with $703 million of the total inflows last week, nearly all of it. Meanwhile, funds betting against Bitcoin saw a slight decrease, with outflows of $5.3 million, coinciding with a slight increase in Bitcoin’s price. Bitcoin’s price has increased by 3% over the last week to $43,341, although it is still down by about 12% since the launch of the spot bitcoin ETFs on January 11.

The newly established nine U.S. spot bitcoin ETFs, not including GBTC, have seen an impressive average of $1.9 billion in inflows over the past four weeks, totaling $7.6 billion. When considering GBTC’s $6 billion in total outflows, the net inflows for these ETFs are around $1.6 billion.

The majority of last week’s inflows, $721 million, were focused in the U.S., while Canada and Sweden saw outflows of $31.3 million and $8.2 million, respectively.

As for investments in other cryptocurrencies, Solana led with $13 million in inflows. In contrast, ether and Avalanche funds experienced outflows of $6.4 million and $1.3 million, respectively.