The digital currency landscape is once again at the forefront of financial discourse as Bitcoin’s value slides under the $43,000 threshold, casting a shadow of uncertainty across the cryptocurrency market. This downturn aligns with escalating apprehension over a potential liquidation of Grayscale investments and hints from the Federal Reserve of a postponed rate cut, stirring the pot of market speculation.

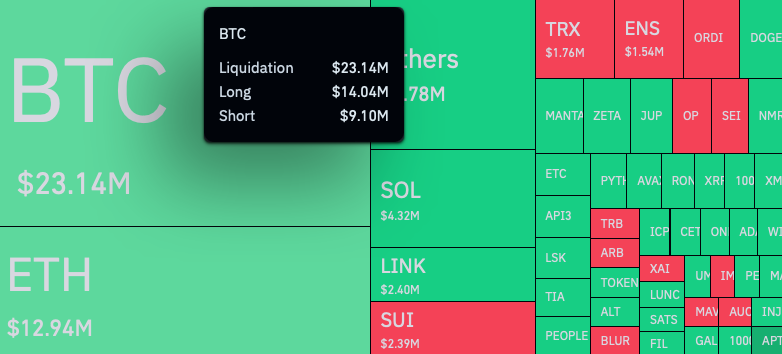

An eye-catching buildup of call options aiming for a $50,000 strike price by February 23 on Deribit has not gone unnoticed, spotlighting the optimistic outlook of some traders despite the prevailing bearish mood. As of Monday, Bitcoin, the crown jewel of cryptocurrencies, witnessed a slight decline of over 0.5% in the last 24 hours, touching $42,676 at midday ET, as reported by The Block’s Price Page. This recent price fluctuation has led to the liquidation of cryptocurrency long positions exceeding $75 million, with a significant portion of this, nearly $30 million in Bitcoin leveraged positions, evaporating in the same time frame, according to Coinglass insights:

In a dramatic turn of events, Genesis Global Capital, a crypto lender navigating bankruptcy, has sought the green light from the U.S. Bankruptcy Court in New York to offload about $1.6 billion in trust assets. This portfolio, housed under the Digital Currency Group umbrella, primarily consists of Grayscale Bitcoin, Ethereum, and Ethereum Classic Trust shares, totaling an approximate value of $1.4 billion, $165 million, and $38 million, respectively.

On the broader economic stage, the Federal Reserve has hinted at a delay in the anticipated interest rate cuts, now possibly pushed to May 2024 or later, according to recent statements. This adjustment in monetary policy timelines is a significant pivot from earlier market expectations of a March rate cut, as Jerome Powell, the Fed Chair, emphasized the central bank’s commitment to ensuring inflation retreats to its 2% target.

Despite the current market turbulence, the derivatives sector continues to showcase a bullish stance on Bitcoin for the medium term. The concentration of $50,000 call options for the upcoming February 23 expiry underscores a robust belief among traders in Bitcoin’s potential to rebound. With over 3,899 contracts hanging in the balance, representing a notional value north of $166 million, the derivatives market is aflutter with anticipation.

This intricate dance of market forces, from bankruptcy proceedings and federal monetary policy to derivative market dynamics, paints a complex picture of the cryptocurrency ecosystem. As traders and investors navigate these uncertain waters, the allure of Bitcoin, with its promise of significant returns and transformative potential, keeps the financial world keenly watching, suggesting an unpredictable yet compelling path forward.