In this dynamically changing world, cryptocurrency has stood out as a game changer, and an understanding of the on-chain indicators becomes crucial for assessing the market. This write-up aims to provide a comprehensive understanding of these essential tools of crypto analytics.

On-chain indicators: Unmasking the crypto world

In the fantastical world of cryptocurrency, on-chain indicators are akin to the compass, guiding us through the rough and often unpredictable terrain of digital currencies. Origins of this term point towards the blockchain technology underpinning cryptocurrency. Simply put, these indicators refer to all transactions recorded permanently on the public ledger. Grasping the subtleties embedded in these on-chain indicators is akin to acquiring the keys to the crypto universe.

Interpreting On-chain Indicators

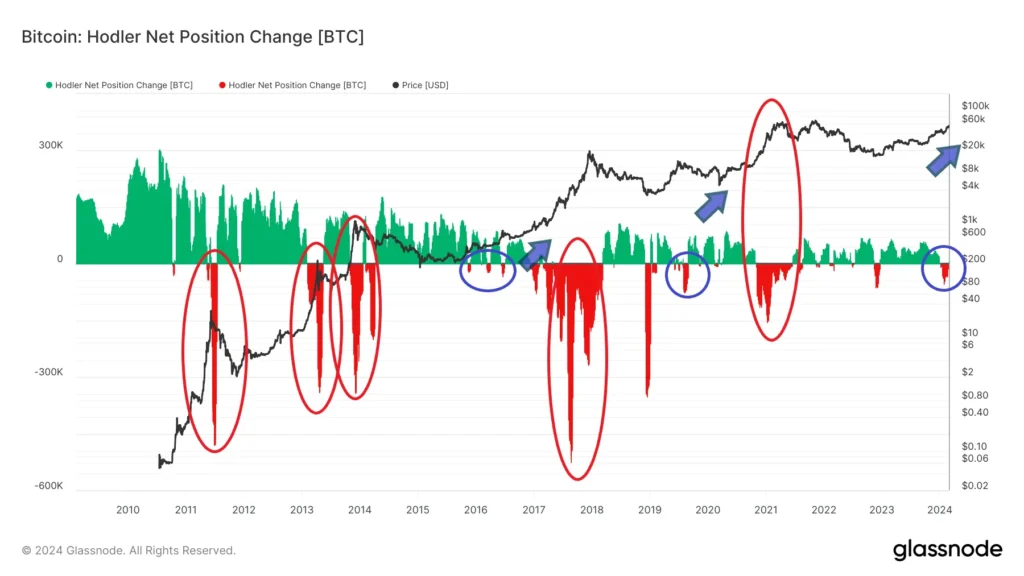

Interpreting on-chain indicators is not a matter of mastering complex graphs and obscure charts. It’s about sussing out the undercurrents that move the digital currency market. To put it in perspective, consider this; these indicators aid in forming an understanding of when the whales (the big movers in crypto) are trading.

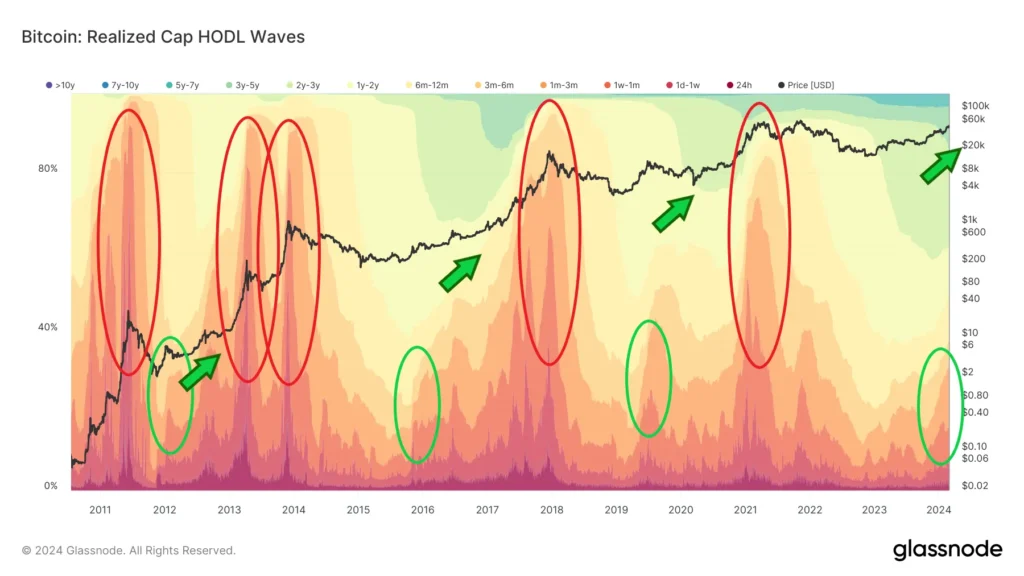

To understand whales, it’s crucial to know the importance of HODL Waves. HODL Waves are a vivid representation of the age of Bitcoin addresses, which is essentially a visual timeline that stretches back for months or years. Staying updated about these indicators can provide a head start in the world of crypto trading and forecasting.

Analysing Market Health with On-chain Indicators

Let’s now dive into some frequently used on-chain indicators, starting with transaction counts and transaction values. These parameters are the cornerstones in assessing the market’s health and vibrancy. An increase in transaction count signifies a thriving market. Correspondingly, the average transaction value can shed light on the market’s overall fortune.

Another key indicator is the hash rates—an indicator of a cryptocurrency network’s computing power. A thriving hash rate is synonymous with robust network security and a buoyant market. Lastly, it’s worth noting the correlation between sharp price drops and spikes in NVT Signal. This might indicate a potential market top and offer possible insights for traders.

Bull Market: A Case Study

Consider a bull market scenario, widely revered in the financial landscape, where price increases and positive trends are prominent. Insights from on-chain indicators can be pivotal during such phases, providing indicators about the sustainability of the bull run and impending corrections.

This article has painted a broad picture of the importance of on-chain indicators in navigating the crypto market. However, the essence of cryptocurrency lies in its volatile, dynamic nature that frequently defies all odds. Just like in any investment, understanding and interpreting these signals is vital but should be followed judiciously along with other methods of analysis, which always adds layers of security to your financial landscape.