Polymarket Traders Predict Fed’s Rate Decision

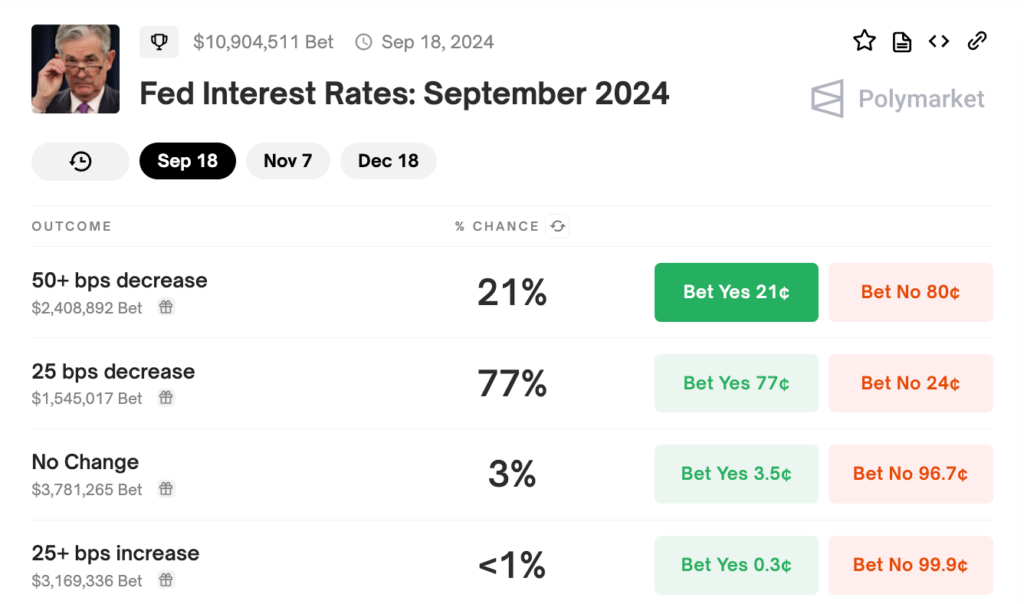

In a revealing testament to the pulse of economic speculation, over 70% of traders on Polymarket are currently betting that the Federal Reserve will opt for a 25-basis-point cut in its forthcoming rate decision. This anticipation underscores a broader sentiment within financial circles, reflecting the nuanced interplay between market expectations and the Fed’s policy maneuvers.

The Federal Reserve’s role as the guardian of monetary policy has never been more scrutinized. As economic indicators fluctuate and the specter of inflation looms, each decision by the Fed carries significant weight. The current consensus among Polymarket traders suggests a belief that the Fed will lean towards easing financial conditions by trimming the rate by 25 basis points; a move considered to stimulate economic activity.

Polymarket’s Predictive Insight

Polymarket, a decentralized prediction market, functions akin to a barometer for collective intelligence. By allowing users to bet on the outcome of real-world events, it aggregates a wide spectrum of opinions into a singular, tradeable metric. In this case, the heavy skew towards a rate cut reflects a predominant sentiment that economic conditions warrant a lighter monetary touch.

The anticipation of a 25-basis-point reduction isn’t arbitrary. It’s deeply rooted in current economic observations and signals sent by the Federal Reserve itself. Over the past months, the Fed has faced a precarious balance: combatting inflation while not stifling growth. Their cautious, data-driven approach has left traders scouring reports for any hints of future moves.

Economic Backdrop and Market Sentiment

Lately, a cocktail of economic signals has pointed towards a slowing momentum. Employment growth, while steady, hasn’t been booming, and key sectors such as manufacturing show signs of strain. The international stage also presents its challenges, with global trade conflicts and geopolitical tensions adding layers of uncertainty. Against this backdrop, a rate cut could serve as a preemptive measure to keep the economic engine humming.

Moreover, inflation remains a pivotal concern. Although it has moderated from its peaks, it’s not entirely tamed. A minor rate adjustment could be seen as a middle path, aiming to support continued recovery while not letting inflationary pressures resurface.

Traders’ Interpretations and Implications

The traders’ bets on Polymarket convey a profound interpretation of these factors. It’s not just about a singular decision; it’s about the broader trajectory of the Fed’s policy and its long-term impact on the economy. Should the Fed indeed opt for the expected rate cut, it would validate the market’s predictive capability and reinforce Polymarket’s utility as an analytical tool.

On the flip side, if the Fed deviates from this anticipated course, it will spark a reevaluation of the economic indicators and the Fed’s strategic priorities. Such an outcome could lead to increased volatility as traders and analysts scramble to adjust their models and assumptions.

Conclusion

In essence, the concentrated bet on a 25-basis-point cut by Polymarket traders encapsulates the intricate dance between market intuition and regulatory action. It highlights a collective belief in the need for a subtle easing of monetary policy amidst a complex economic landscape. Whether this prediction holds true will soon be revealed, but undoubtedly, the vibrant dialogue between traders and policymakers continues to be a fascinating spectacle of financial forecasting.